This guide covers the basics of recurring billing, including how to manage subscriptions, how a billing solution works, and to save time and recover more revenue.

- Introduction

- Basics of recurring revenue

- How a billing solution works

- How Stripe can help

Recurring revenue unlocks growth and engagement, improves cash flow, lowers customer acquisition costs, and streamlines operations. Each year, more online companies adopt recurring revenue models—in fact, tens of thousands of businesses joined Stripe to manage their online recurring revenue in the past year.

To manage recurring payments, companies must build or integrate a billing system. While a billing system acts as the infrastructure that operationalizes a recurring customer relationship, when done correctly, it can also be a fundamental part of your business—instrumental in building customer loyalty and increasing revenue.

Building your own billing system is unnecessarily complex and expensive. For example, you need to make sure you can correctly bill the customer based on the pricing model (flat-rate billing or tiered pricing, for example), manage billing and prorations across a customer’s lifecycle (upgrades and renewals, for example), drive acquisition and renewals with free trials and discounts, and support whichever payment methods customers prefer to use.

In this guide, you’ll learn the basics of recurring billing. We’ll cover how to manage subscriptions, how a billing solution works, and how Stripe can help. You’ll also learn how companies like Postmates, Noom, Deliveroo, and eero manage recurring billing to save time and recover more revenue.

What are the basics of recurring revenue?

To take advantage of the benefits of recurring revenue, you need a way to create subscription plans and manage them over the course of a customer relationship. That means collecting information to accurately bill customers at the correct time and at the correct price.

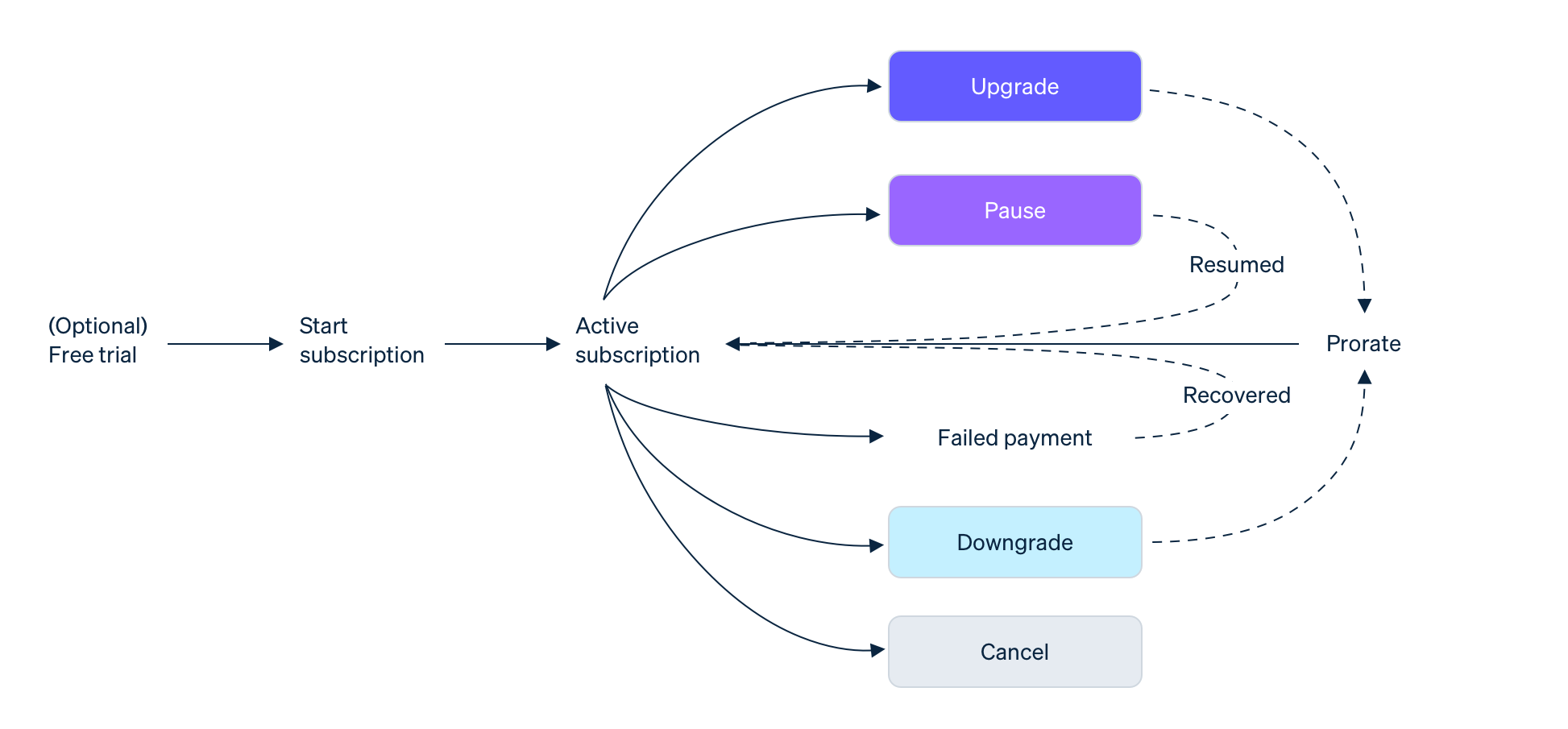

It also means accommodating the entire subscription lifecycle, adjusting pricing and plan terms if customers upgrade, downgrade, pause, renew, or cancel. Your billing system should also account for customers changing plans at any time. If someone wants to switch to a cheaper plan mid-month, you have to prorate the costs of both plans and ensure that the customer will be charged for the right amount going forward.

Any billing system will not only process customers’ initial payments, but it will also securely and safely store their payment details on file and reuse them each time a bill is due. The ability to reuse a customer’s payment credentials allows you to initiate payments on a custom schedule, without requiring any action by your customers. Cards, wallet, and bank debit payments are all reusable—customers only need to provide their card number or bank account details once.

In order to reuse payment details for recurring transactions, it’s crucial that you get customers’ permission up front. Recurring billing systems will make it seamless for customers to agree to terms that include the following (at a minimum):

Permission to initiate a series of payments on their behalf

Frequency of payments

Details on how the payment amount will be determined

There are also laws and regulations governing what information businesses need to collect from subscribers when they first sign up in order to process recurring charges. For example, Strong Customer Authentic (SCA) requires that businesses use two-factor authentication, like 3D Secure, to verify many online purchases in Europe.

Great billing systems are also flexible enough to meet the evolving needs of your business as you scale. To produce more and more original content, recurring businesses regularly evolve their packaging and pricing in response to competition, changes in customers’ willingness to pay, and investments in their product offerings. To enable those changes, businesses look to their billing systems to migrate subscribers from old plans to new ones.

How does a recurring billing solution work?

A recurring billing system helps automate every part of recurring relationships, from charging customers on a regular basis to retrying late payments at the ideal time.

Many businesses try to build a subscription and billing management software themselves, but underestimate the long-term complexity and costs. A homegrown solution needs to be continuously maintained to support new product launches, business models, pricing experiments, global expansion, changes in regulatory requirements, and a host of other challenges as businesses grow.

A prebuilt billing solution allows you to get started immediately and also offers the flexibility and features to support you at scale.

While any billing solution should be customizable, it should also handle the following six basic tasks.

1. Accept orders

Your billing solution should integrate with your purchase flow, allowing you to issue quotes or invoices, and accept orders online, in person, or on a mobile device. If new customers subscribe through a web or mobile checkout, your billing system can connect via an API to automatically generate a subscription. If, however, you need to create a subscription manually, your billing system should connect to a dashboard so you can input the details directly.

It should also support your current sales motion and any potential business models in the future. For example, consider your current sales strategy. Does a sales team manage new user outreach and renewals, or is your product or service sold online via a self-serve model? Do you have a finite set of standard products or are most of your orders customized? Your billing solution should be able to accommodate these considerations now and as you scale your business.

2. Set flexible billing logic

Subscription logic is made up of time-based and price-based rules that, together, accurately charge your customers on a predetermined cadence. When you only have one product and flat-rate pricing, like $25 per month for a software subscription, setting up this logic in your billing system is easy because the dollar amount doesn‘t change from month to month.

However, online businesses are rarely simple or static. Billing systems need to be dynamic enough to handle the inevitable, and sometimes sudden, changes that businesses undergo. An ideal billing solution should give you the flexibility to experiment with different pricing models like usage-based pricing, where billing changes based on how many gigabytes of storage customers use or how many users are active each month. You could also try tiered pricing and charge different prices depending on which package of features customers choose.

To respond to new competitive threats or customer demands, your billing system should allow you to test promotional discounts or introduce a free trial. You might also want to set a subscription schedule, where you charge customers an introductory rate and then automatically change the price after a set number of billing cycles. Business or economic conditions might also change unexpectedly, so it’s important to be able to pause subscriptions if a customer needs to take a break or services cannot be rendered.

Set flexible billing logic

Over time, you might even introduce a new tier of your product or service to create an additional revenue stream. On-demand food delivery service Deliveroo did just that. With the help of Stripe, they launched Deliveroo Plus, which offers free delivery for a monthly subscription fee. In addition to increasing recurring revenue, Deliveroo Plus also boosted retention among users who adopted the new service.

3. Collect payments

Customers expect a relevant, familiar payment experience, and the easier you make the payment process, the more likely you are to generate sales. For subscription-based business models, companies often collect credit card information during checkout and then charge the card every month in the background. However, you should also ensure that your billing solution supports a variety of payment methods, such as ACH credit, ACH debit, checks, digital wallets, and bank transfers.

It’s important to customize payment methods based on customer preferences. For example, consider supporting bank transfers so customers can easily and securely make large payments. Or, to expand globally, you can offer local currencies and payment methods, like Noom did. In Germany, the digital health platform discovered that direct debit was a higher priority for customers than credit cards. With Stripe, Noom could easily accept this popular payment method, test different local payment methods, and offer more payment flexibility to its customers around the world.

4. Grow revenue

Most SaaS and subscription companies face involuntary churn issues, where a customer intends to pay for a product but their payment attempt fails due to expired cards, insufficient funds, or outdated card details. In fact, involuntary churn accounts for up to 25% of customer churn.

With a billing solution, you can build automations to reduce the rate of involuntary churn. You can send automated emails whenever a card expires or a payment is declined. Billing systems can also update expired cards and automatically retry failed transactions on a customized schedule—for example, every seven days—to increase the chances of a successful payment.

Postmates, an online delivery marketplace, added more than $63 million in revenue by working with Stripe to reduce involuntary churn. With Stripe’s card account updater (CAU), more than two million expired or replaced customer cards were automatically updated on Postmates, which translated to $60 million in revenue. Stripe Billing’s Smart Retries also recovered more than 200,000 payments that originally failed, adding $3 million in additional revenue.

Your billing system also plays an instrumental part in minimizing voluntary churn. If a user wants to change their payment method, view their billing history, or even end their subscription, a dedicated portal or dashboard should make it easy. To increase retention, that same portal can dynamically offer customers alternatives based on their cancellation reasons. For example, if a customer thinks your price is too high, you could encourage them to downgrade to a cheaper plan or pause their subscription instead.

5. Integrate with internal systems

Your billing solution should serve as an official record of the customer lifecycle, allowing you to make critical business decisions based on subscriber activity. For example, you could automatically notify other internal systems when new subscriptions, payments, or cancellations occur, prorate billing based on plan changes, and configure rules to automatically or manually renew customers’ subscriptions.

To cover the full customer lifecycle, your billing system will need to integrate with other existing workflows, especially accounting systems and ERP solutions like Xero, QuickBooks, and more.

eero, a WiFi hardware and software company, integrated Stripe Billing with NetSuite, saving more than 50% of the time they’d previously spent closing their financial books at month’s end. They used Stripe’s prebuilt integration with NetSuite, which automatically syncs Stripe data with the NetSuite ledger for easy and fast reconciliation

6. Monitor key business metrics

Given that your billing software manages your customer relationships, it’s a crucial source of insight into your customers and business. To serve the reporting and compliance needs of your company, any billing system should provide full visibility into subscription data. It should offer automated reports and dashboards to create a single source of truth about your revenue, removing operational friction and enabling everyone to identify insights and trends.

Fundamentally, a billing system’s reporting should allow you to monitor these key metrics:

SaaS metrics such as monthly recurring revenue (MRR), churn, and lifetime value (LTV)

Subscription analytics such as net-new customers, expansions, trials, and cohort analyses

Recovery and churn analytics such as recovered revenue

How Stripe can help

Stripe Billing is the most flexible way to manage subscriptions. You can start collecting one-time or recurring payments right away, and test and roll out changes via our API or right in the Dashboard.

Using the same provider to process payments and bill subscribers allows you to deepen subscriber loyalty, increase revenue, and get better insights into your customers and revenue. All the core payment building blocks—such as revenue recognition and analytics—are readily available and connected. You can accept cards, ACH, and a variety of payment methods to reach customers globally from day one. And when we release new payment methods, you can be confident they’ll work with Stripe Billing.

Get started quickly: Start accepting recurring payments in minutes. Use Stripe Invoicing to create and send invoices online. Collect payments from existing customers or share a payment link to sell a subscription—no code required. Use prebuilt, Stripe-hosted pages to make it fast and easy for customers to subscribe and manage their subscriptions and billing details.

Support any billing model: Stripe Billing offers flexible billing logic for everything from per-seat pricing to metered billing out of the box. In addition, support for coupons, free trials, prorations, add-ons, and overages is built-in.

Collect more revenue: Stripe uses millions of data signals from across the Stripe network to retry failed payments when they’re most likely to succeed. Stripe also leverages its direct relationship with card networks to update payment details with new card numbers or expiration dates. In 2019, Stripe Billing helped businesses recover 41% of failed invoices on average.

Optimize operations: Understand your growth, churn, and retention rates with automatically generated reports. Easily sync billing and payments data with the rest of your workflows.

For more information on Stripe Billing, read our docs. To start billing customers and accepting payments right away, sign up for an account.