Software-as-a-service (SaaS) platforms like Shopify, Xero, and Jobber built their businesses around solving a customer pain point—like starting an online store, managing finances, or scheduling home services—and charging a monthly fee to access that service. As these platforms grow, and often at their investors’ insistence, many start exploring how to offer more services they can monetize. Today, platforms are diversifying their revenue streams by monetizing payment features and generating new lines of business.

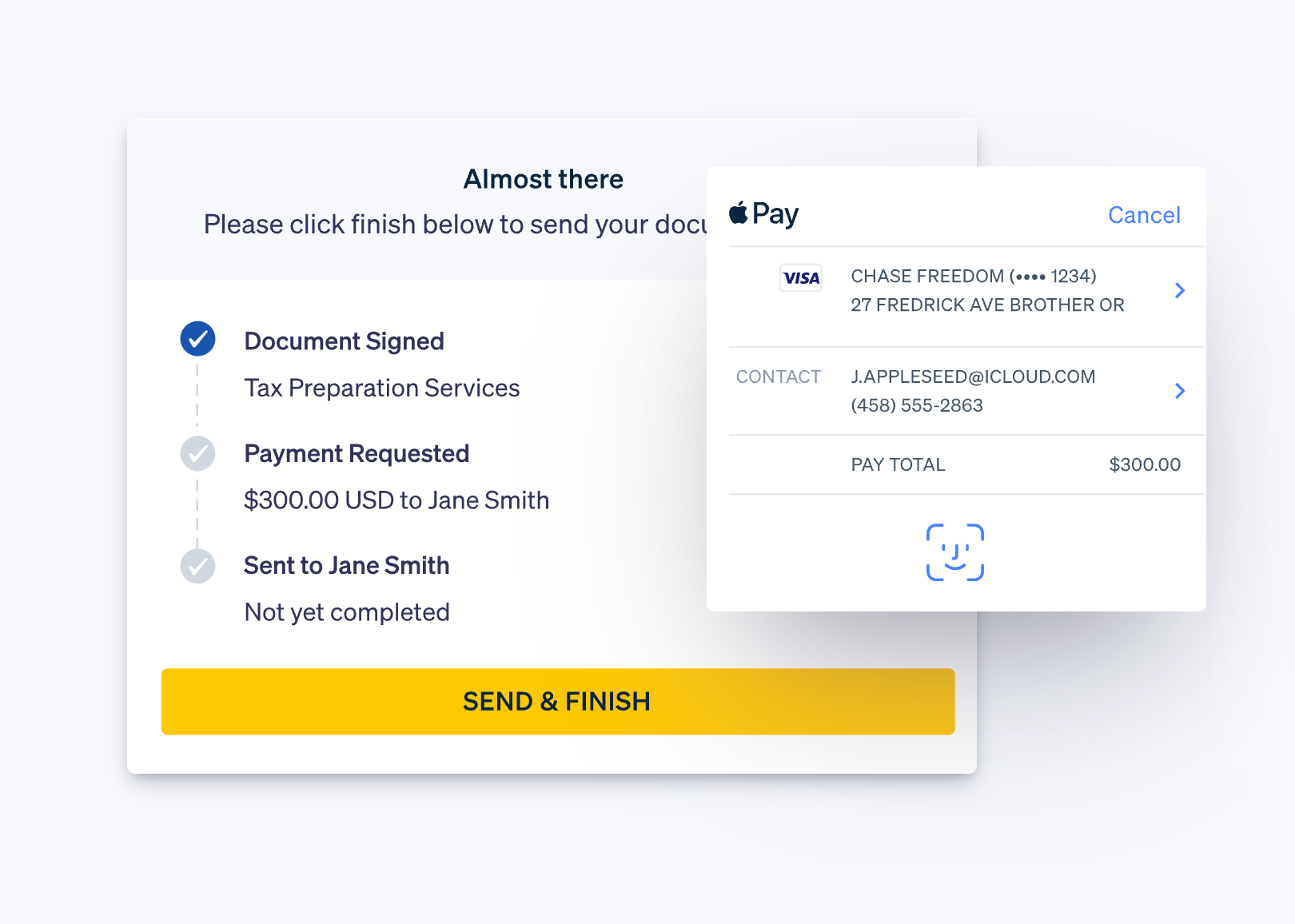

Payments are often at the core of solving key business needs. By integrating payments into your platform, you can offer a more convenient product experience while eliminating the costs, delays, and non-payment risks of manual billing. For example, DocuSign customers had asked for the ability to request signatures for contracts and payments in one step. DocuSign partnered with Stripe Connect to launch DocuSign Payments, making it possible for customers to request payments at the time of signature. Since launching, DocuSign Payments has processed over $350 million, helping customers get paid faster while delivering a quality customer experience.

This guide covers the basics of payment monetization for platforms, from how to monetize payments for the first time to how to charge for other features and services. You’ll learn best practices for monetizing payments, different ways to experiment with pricing, and how Stripe can help.

How to monetize payments

You generally have two options when deciding how to monetize payments: You can charge customers for payments and payment-related features, or depending on your agreement with your payments provider, you can enter into a revenue-sharing agreement.

Stripe offers the ability for you to earn a revenue share from online payments or customize pricing for your customers. Learn more.

If you're looking to monetize payments for the first time, charging for payments and payment-related features is a good place to start. This approach gives you more control and flexibility over the cost structure, and allows you to experiment with different pricing and packages.

You don't have to focus only on one monetization option either—in fact, it may be more beneficial to your business to create multiple revenue streams. For example, if you're interested in marking up each transaction, you may also want to add monthly fees for access to more advanced payment features so you're not solely relying on payment volume.

Here are five primary ways to charge customers for payments and payment-related features:

1. Charge customers a fee to access payments: Bundle payments with other premium features and create a higher-priced plan. For example, Squarespace offers four plans: Personal, Business, Commerce (Basic), and Commerce (Advanced). The Personal plan is the cheapest but doesn't offer any payment features. The other three plans are more expensive but allow customers to process payments.

|

Basic plan

$10/month |

Advanced plan

$25/month |

|

|---|---|---|

|

Collect payments

|

||

|

Accept donations

|

||

|

Sell gift cards

|

||

|

Point of sale

|

||

|

Sell subscriptions

|

||

|

Advanced discounts

|

2. Mark up each transaction: One of the more straightforward approaches to payment monetization is to charge a transaction fee for each payment processed on your platform.

Just like charging customers a fee to access payments, you could also create different tiers of payment plans that handle this markup differently.

For example, if customers pay for a more expensive payment plan, the transaction fee is lower.

|

Basic plan

$10/month |

Advanced plan

$25/month |

|

|---|---|---|

|

Online credit card rates

|

2.9% + 30¢ | 2.75% + 30¢ |

3. Add fees for advanced payment features: Focus on differentiating your payments, offering to create a better user experience. You could offer premium features, like chargeback protection or giving customers the opportunity to get paid out faster, like StyleSeat offers. StyleSeat helps beauty professionals grow their business with tools that help them get exposure to new clients and make more money. Customers can choose to have their money instantly deposited into their bank account or debit card for a flat $0.50, rather than waiting one to two business days.

4. Charge a fee if customers use other payment gateways: Many platforms consolidate payments with one provider to help lower transaction costs and add fees if customers choose to use a different payment service. Shopify charges up to 2% in additional fees, depending on the plan, if customers process payments with a provider other than Shopify Payments.

|

Fraud analysis

|

|||

|---|---|---|---|

|

Online credit card rates

|

2.9% + 30¢ | 2.6% + 30¢ | 2.4% + 30¢ |

|

In-person credit card rates

|

2.7% + 0¢ | 2.5% + 0¢ | 2.4% + 0¢ |

|

Additional fees using all payment providers other than Shopify Payments

|

2% | 1% | 0.5% |

5. Charge for advanced, customized reporting: Use data from your payments provider in creative ways to make your own platform more valuable to your customers. For example, Shopify offers a tool that allows its customers to build custom reports in its highest-tiered plan.

Pricing considerations

Regardless of how you choose to monetize payments, make sure to charge enough to make an impact on your bottom line while staying competitive. Your fees should account for both the added value you're providing to customers and any additional transaction costs you may incur. Some factors to consider include what your competitors' pricing models look like and how their feature sets differ.

To better understand how your customers may respond to your new payments offering, start with a series of small tests rather than introducing the new plans to everyone at the same time. Perhaps you send an email announcing your new payment features, with pricing details, to a small group of customers. This allows you to better monitor customer feedback and sentiment. Or, you could run an A/B test on your pricing page and track sign-ups to see how different types of plans perform.

You can also consider customizing your payments monetization strategy based on your customer segments. For example:

- For smaller customers who haven't started selling online yet, you could consider offering a free trial of your ecommerce package (e.g., waiving monthly fees for three months) to get them started.

- For larger, strategic customers, you may want to offer discounts or promotions as a way to close more deals. Or, you could consider bundling payments pricing with value-added features like fraud protection.

- For customers who have physical locations or sell in-person, you may want to promote your online and offline payments solution by running promotions on the payment devices (e.g., buy one device, get the second free).

How to monetize other services

Once you find a successful pricing model for payments, you can experiment with other monetization opportunities. As you’re exploring additional payment-related features or services to offer, make sure to focus on where you can add the most value to your customers. For example, if you know your customers are interested in expanding globally, you can help them improve their checkout experience by offering localized payment methods and Adaptive Pricing at checkout.

Here is an overview of three monetization opportunities:

|

Monetization opportunity

|

Description

|

Features to offer

|

|---|---|---|

| International expansion | Support your customers as they expand their business globally |

|

| Financial services | Help customers streamline financial operations |

|

| New business models | Allow your customers to experiment with different business models |

|

How Stripe can help

Platforms of all sizes—from new startups to public companies like Shopify—use Stripe Connect to accept money, pay out to third parties, and monetize payments. You can quickly launch a payments service, collect a portion of each transaction, and customize payments pricing for your customers. You can also monetize a variety of products, such as invoicing, subscription billing, or in-person payments—all from one unified integration. Monetizing these services allows you to process more total volume on your platform, generating more revenue and making your offering more compelling for your customers.

Stripe Connect lets you monetize and offer the following features to your customers:

- Online payments: Enable your customers to accept payments in minutes. They can build a checkout experience tailored to their business needs, protect their payments from fraud, and localize their payments experience to increase conversion abroad.

- Point-of-sale payments: Help your customers expand into the physical world by enabling their own in-person checkout. Stripe Terminal allows them to manage their online and offline sales in one place with a single integration, simplifying reporting and reconciliation.

- Subscriptions: Allow your customers to experiment with new business models by offering flexible subscription and billing plans with Stripe Billing. They can iterate on pricing—testing one-time, recurring, usage-based, or tiered subscriptions—and offer promotions and trial periods. They can also reduce churn with smart retry logic and easily expand globally, accepting any supported payment method.

- Recurring and one-time invoices: Help your customers get paid faster with integrated invoices. They can send recurring invoices for subscriptions or one-off invoices with built-in support for credit and debit cards, customizing them to match their brand and applying inclusive or exclusive tax rates for different locales.

- Payments cards: Create, distribute, and customize virtual and physical credit cards for your customers with Stripe Issuing. You can design branded cards, set dynamic spending controls, and enable your customers to fund the cards with their own bank accounts.

- Reporting and analytics: From out-of-the-box summaries to customizable reports, Stripe Sigma offers a range of reporting options that you can integrate into your own platform. You can pull data from the Stripe API and add it directly into your own reporting features, or point customers to the Stripe Dashboard for payments-specific data.

We hope this guide has given you a high-level overview of how you can create additional revenue streams from payments and other financial services, and how Stripe can help.

For more information on Stripe Connect for platforms, read our docs or contact our sales team. If you want to start accepting payments right away, sign up for an account.