As an itinerant trader, you can provide goods or services wherever needed. By meeting demand, you can expand into new areas and reach additional customer groups. However, the requirements for registering an itinerant trade are more stringent than those for a stationary business.

In this article, you’ll learn what an itinerant trade is, the requirements it must meet, and how to register one. We’ll also share some practical tips to help you start your business on the right foot.

What’s in this article?

- What is an itinerant trade?

- What are some examples of an itinerant trade?

- What requirements must an itinerant trader in Germany meet?

- How do I register as an itinerant trader?

- How to start your itinerant trade successfully

What is an itinerant trade?

In Germany, an itinerant (traveling) trade (known as “Reisegewerbe” in German), is a unique type of commercial activity. It involves providing services or selling goods outside of a permanent business location. This contrasts with a stationary business—for example, a brick-and-mortar shop—where customers visit the trader.

Itinerant traders go to the customers or offer their goods in public places. An important requirement is that the customers must not have previously contacted the itinerant trader. The goods or services are thus offered without a prior request or order.

With a few exceptions, nearly all activities that can be conducted in a stationary business are also achievable in an itinerant trade.

The legal basis for itinerant trades is found in trade law, specifically in the German Industrial Code (GewO). For example, Section 55 of the GewO outlines what constitutes an itinerant trade and the requirements that must be met for registration.

You can find information on the difference between freelance and commercial activities in our article on self-employment in Germany.

What are some examples of an itinerant trade?

Itinerant trade activities encompass a range of mobile sales and services provided directly to customers or at various locations. Here are some examples:

- Sale of goods: Itinerant traders can sell their products at weekly and annual markets, trade fairs, and other events. Door-to-door sales are also considered itinerant trades. For example, they could sell household goods, cleaning products, and textiles.

- Food and beverages: Anyone who sells food or drinks at various locations is also involved in an itinerant trade. Common examples include snack vans or food trucks.

- Cleaning and care services: Mobile cleaning services are also considered an itinerant trade. This involves cleaning and maintaining windows, carpets, or vehicles on-site, among other duties.

- Consultancy services: Itinerant traders can serve as mobile consultants, providing advice on products such as insurance or cosmetics directly in customers’ homes.

- Traditional craft services: Craftspeople can also offer their services as itinerant trade. Mobile craftspeople include scissor grinders, shoemakers, or hairdressers who provide their services directly at the customer’s home.

- Entertainment services: Anyone running carousels, shooting galleries, or other entertainment stalls as a showperson is also classified as an itinerant trader. This also includes street performers such as musicians, jugglers, or magicians who perform in public areas.

According to Section 56 of the GewO, certain activities are prohibited for an itinerant trade. For example, securities trading is prohibited. Lottery tickets may only be sold in public places and must be part of approved lotteries for charitable purposes. Transactions in precious stones, precious metals, and pearls are also prohibited. The same restriction applies to medical and orthopedic devices, such as eyeglasses, electronic hearing aids, or orthopedic foot braces. Beer and wine may be sold in sealed containers; other alcoholic beverages may be sold only if they are sold for consumption on the premises from a fixed place of business. In addition, the sale of poisons and items containing poisons is prohibited.

What requirements must an itinerant trader in Germany meet?

An itinerant trade in Germany must comply with various legal and practical requirements. The main condition for registering one is to obtain an official permit. This is issued in the form of an itinerant trade card—often called the itinerant trade license—and confirms that the operator meets the legal prerequisites. Once you have obtained your itinerant trade license, you can operate a business anywhere in Germany. It is important to carry the license with you at all times while conducting business and to produce it when requested by the authorities.

Setting up a business without an itinerant trade license

However, according to Section 55a of the GewO, not all itinerant traders must obtain an itinerant trade license. This exemption applies to individuals who sell goods at public events occasionally and have specific permission from the relevant authorities. Food and other everyday items can also be sold without an itinerant trade license if they are sold at regular, short intervals at the same location—for example, vendors who sell their products at the same market every week. Itinerant vendors who offer goods and services only within their home municipality do not need one, provided the municipality has fewer than 10,000 inhabitants.

Those selling home-grown products from agriculture, forestry, vegetable growing, fruit growing, horticulture, poultry farming, beekeeping, and hunting and fishing are also exempt from the itinerant trade license requirement. Additionally, the sale of books, other printed matter, and milk products is exempt from requiring the license, as specified in Section 4 of the MilchMargG (Milk and Margarine Act). In most cases, you can also advise on or sell insurance products and build society savings contracts without needing an itinerant trade license.

How do I register as an itinerant trader?

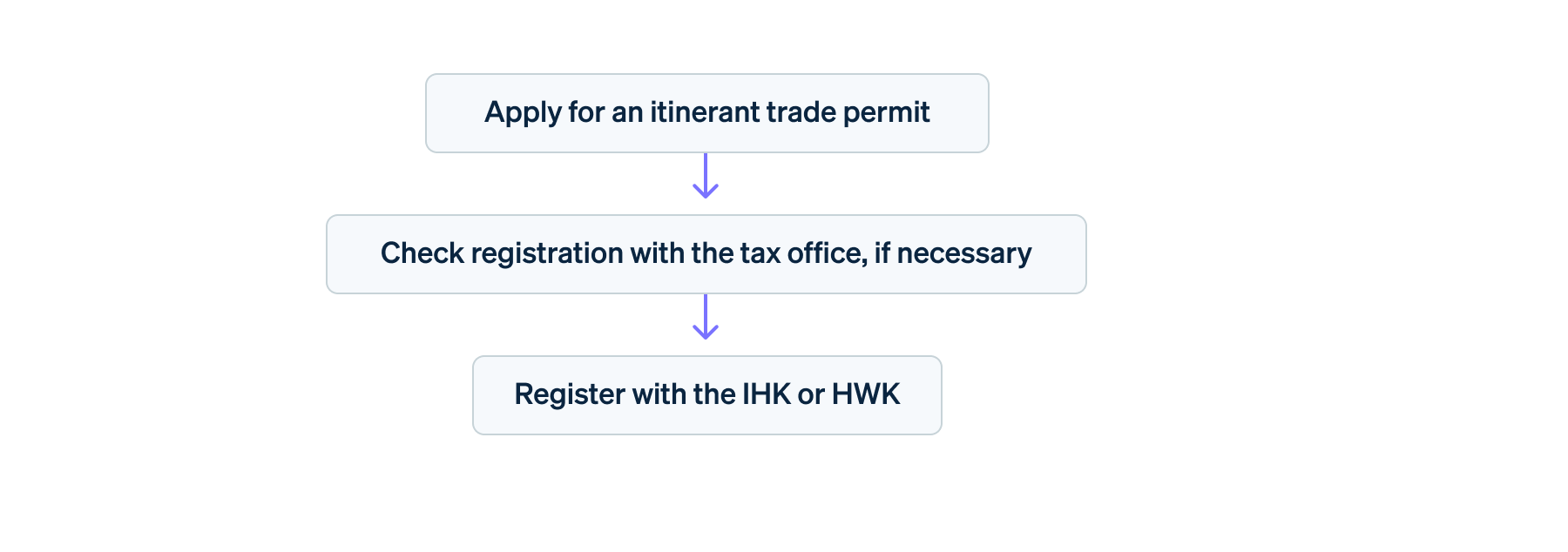

Registering an itinerant trade can be done in just a few steps. First, you need to apply for an itinerant trade card, which requires you to submit several documents to the relevant trade office. In addition to an identity document and a photograph, you must provide an extract from the central trade register and a police clearance certificate. Individuals with a criminal record or with a violation of trade regulations could be denied an itinerant trade license. If your business is in the Commercial Register, you must also submit an extract from it. Additionally, you will need a clearance certificate from the tax office, a residence permit if applicable, and, if trading in food, proof of instruction in compliance with the Infection Protection Act.

The requirements for registering an itinerant trade are stricter than a stationary trade because itinerant traders are harder for authorities to monitor and hold accountable. The trade office reviews all documents and then issues the itinerant trade license. The cost varies depending on the municipality and business. Typically, the fee is between €25 and €400.

The trade office usually notifies the tax office about it registering the itinerant trade. To be on the safe side, check with the tax office to confirm that it has received the relevant information.

Finally, the tax office will send a tax registration questionnaire. Among other details, the expected turnover must be included in this questionnaire, which the tax office uses to calculate the amount of tax due. Itinerant traders must pay trade tax, value-added tax (VAT), and, if applicable, income tax. If you need help calculating and reporting your taxes, consider using Stripe Tax. Tax automatically calculates the correct tax amount and provides access to all relevant tax documents, making it easy and quick to apply for tax refunds.

Depending on the activity and sector, itinerant traders must register with the relevant Chamber of Commerce and Industry (IHK) or Chamber of Crafts (HWK).

Finally, a stand permit must be obtained from the local government office (Ordnungsamt) for planned sales stands. The responsible building authority (Bauamt) might also need to be involved.

Registering an itinerant trade: Step by step

How to start your itinerant trade successfully

Before registering your itinerant trade, you should always verify that your activity qualifies as one. The line between itinerant and stationary businesses can be blurred. To be sure, you should contact your local Chamber of Commerce and Industry or Chamber of Crafts. The trade office can also give you the relevant details.

You should also create a business plan before starting up to assess the economic viability of your company and determine the capital requirements. You can use market research to provide insights into the market size and demand, and to identify competitors offering similar services. After all, the competition includes other itinerant businesses and local companies. You can develop your strategy and define your specific area of focus based on the market research. The anticipated costs and income should also be included in the business plan. You might also need to attract investors.

Itinerant traders should generally carry liability insurance to protect themselves against potential claims. For some individuals in the amusement industry, liability insurance is mandatory—for example, operators of shooting galleries, horse stables, or amusement rides that transport people. Depending on the nature of your business, you might also need additional insurance, such as accident or theft insurance.

While most itinerant traders traditionally handle cash transactions, it’s also wise to explore modern payment options. An increasing number of customers expect the option to pay for goods and services by card. Through Stripe Terminal, you can acquire precertified card readers such as the S700 or a mobile device such as the BBPOS WisePad 3. Alternatively, you can accept card payments using your smartphone in combination with Tap to Pay. This enables you to offer your customers cashless payments while on the move.

Finally, it’s important to promote your itinerant trade. However, the trading regulations impose several restrictions compared to stationary trade, as orders can only be placed on the initiative of the itinerant trader. Exclusively general image advertising is allowed. For example, flyers must not contain contact information. Only the address of the itinerant trader may be printed; telephone numbers and email addresses are not allowed.

The content in this article is for general information and education purposes only and should not be construed as legal or tax advice. Stripe does not warrant or guarantee the accurateness, completeness, adequacy, or currency of the information in the article. You should seek the advice of a competent attorney or accountant licensed to practice in your jurisdiction for advice on your particular situation.