Challenge

Founded in 2018, UK-based Semble is a clinic management solution designed to help healthcare professionals amplify their impact and connect to the wider ecosystem around them. Semble aggregates everything a care provider could need into one place: patient data, appointment management, payments processing, and more.

Semble’s vision for a comprehensive platform included integrated payment processing that would allow clinics to manage the entire patient journey with one streamlined solution that was secure and PCI compliant. Along with payments, Semble wanted a fraud prevention system that could help safeguard both clinics and their patients.

After its launch, Semble identified a need to provide clinics and their patients with payment solutions for both online and in-person transactions at the reception desk.

Additionally, Semble’s manual subscription billing workflow was labour-intensive and error-prone, complicating its process for billing clinics. Semble needed to simplify subscription billing and accounting, and to automate time-consuming tasks such as reconciling incoming payments data.

Solution

Semble’s relationship with Stripe began in 2018 when the company implemented Stripe Connect to combine software services with payment processing, allowing practices of all sizes to manage patient journeys entirely in one software solution. Semble chose Stripe for its API-first approach, which aligned with its need for easy integration and efficient onboarding. The company has since switched from Standard Connect to Express Connect to make it easier for its doctors to manage their payments, speed up and simplify the payment process further, and offer a better omnichannel experience to its customers.

“It’s the sort of SaaS 3.0 transformation that we couldn't have done without Stripe,” said Mikael Landau, co-founder and chief technology officer at Semble.

To strengthen its fraud prevention measures, Semble launched its software with Stripe Radar, which deploys machine learning to continuously adapt to shifting fraud patterns, and 3D Secure, an authentication standard that provides added security to online payments.

As part of its launch, Semble implemented Stripe Elements, a set of embeddable UI components, to meet PCI compliance requirements by ensuring that no credit card information is transmitted to Semble's servers. “With Elements, PCI compliance is easy and payment data stays off our servers. This, combined with fraud detection tools, is a no-brainer for us, and it's one of the core offerings of Stripe that really stands out for us,” said Landau.

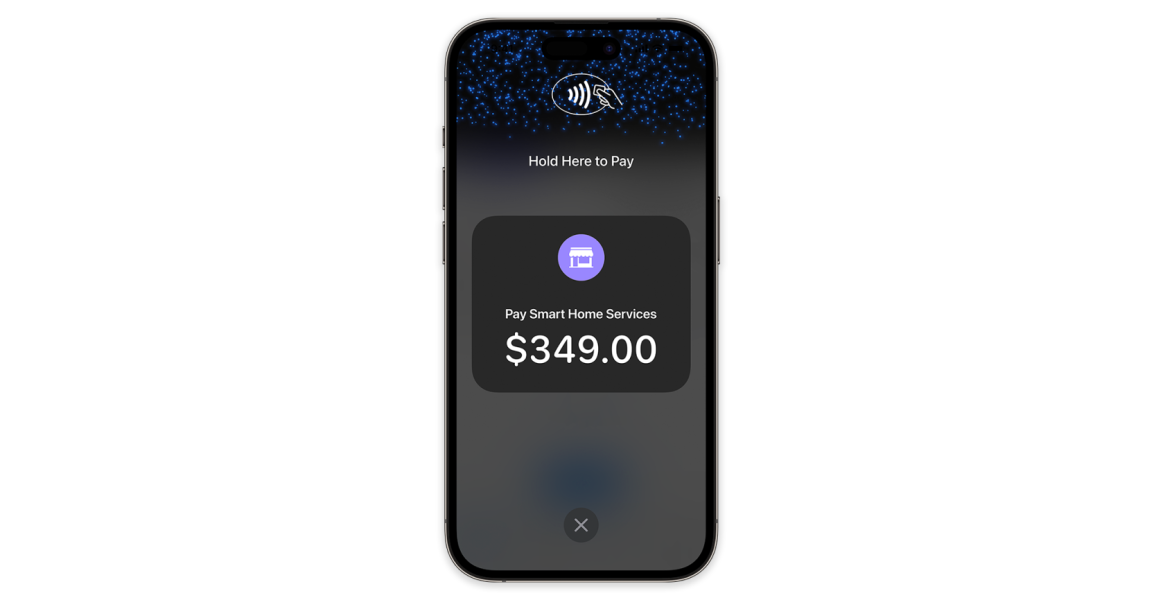

In 2024, Semble expanded its relationship with Stripe to process online and offline payments directly through its software, allowing immediate and effective reconciliation of invoices. Using Stripe's unified point-of-sale solution, Stripe Terminal, clinics are now able to accept in-person payments that directly link to the Semble platform.

In 2022, Semble moved from manual to automated billing using Stripe Billing. Now, the company can update, pause, cancel, and refund clinics subscriptions, as well as generate accurate invoices, directly from its platform. “With Billing, we got rid of all our complicated and faulty manual invoicing processes,” said Landau.

Results

Processing more than £100 million in online transactions for 1000+ customers

Stripe has helped the platform process over £100 million in online transactions. Semble has become a core driver for thousands of clinicians by linking a business’s backend payment processing with its customers’ point-of-sale experience. In turn, this leads to revenue growth for Semble. "Payment revenues are currently low single digit in terms of percentage of our revenues and expected to grow significantly” said Landau. “The more services we can bring users through our solution, including payments, the more money we make and the more viable our business is.”

Secure transaction and near-zero fraud with Radar

In addition to managing payments, Semble can securely manage transactions with protection from Radar. Working with Stripe, the platform activated Radar and integrated 3D Secure to detect and prevent fraudulent transactions, particularly in online bookings. “Fraud has never been a problem for us, and that’s because it’s been taken care of by Stripe. We have close to zero fraud in total,” said Landau.

Winning business by aligning with high security standards

Stripe handles PCI compliance, eliminating the need for a customer’s credit card number to touch the platform server. Stripe Elements also helped Semble win business from large hospitals due to Stripe’s widely recognised alignment with industry security standards, including PCI certification.

Streamlined reporting and reconciliation

Semble uses Stripe to help clinicians keep track of all their online and offline payments in one centralised platform. The more payments go into Semble, the more reconciliations happen automatically. “Being able to simply submit accounting entries or records to their accountants is the biggest saving for customers,” said Landau. “It's a very attractive proposition for practices, and it could increase the amount of money spent with Semble via Stripe.”

Faster bank payments and minimal invoice management time

Using Billing to consolidate both subscription and invoice management allowed Semble to save time and keep revenue flowing. “Our prior invoices had 14-day terms, but with Stripe's direct debit functionality and various payment methods, we can now get paid in a couple of days instead of two weeks,” added Landau. Now, Semble's teams spend almost no time managing invoices.

I've always been attracted to Stripe because of our shared philosophy of customers first. Even as Stripe has grown, they've maintained a personal touch servicing platforms and our shared customers. Their approach to partnership, like organising dinners with senior leadership, makes us feel valued. It's more than just business; it's a human relationship, and that's important to us.