How Carousell worked with Stripe to become the first choice in the second-hand economy

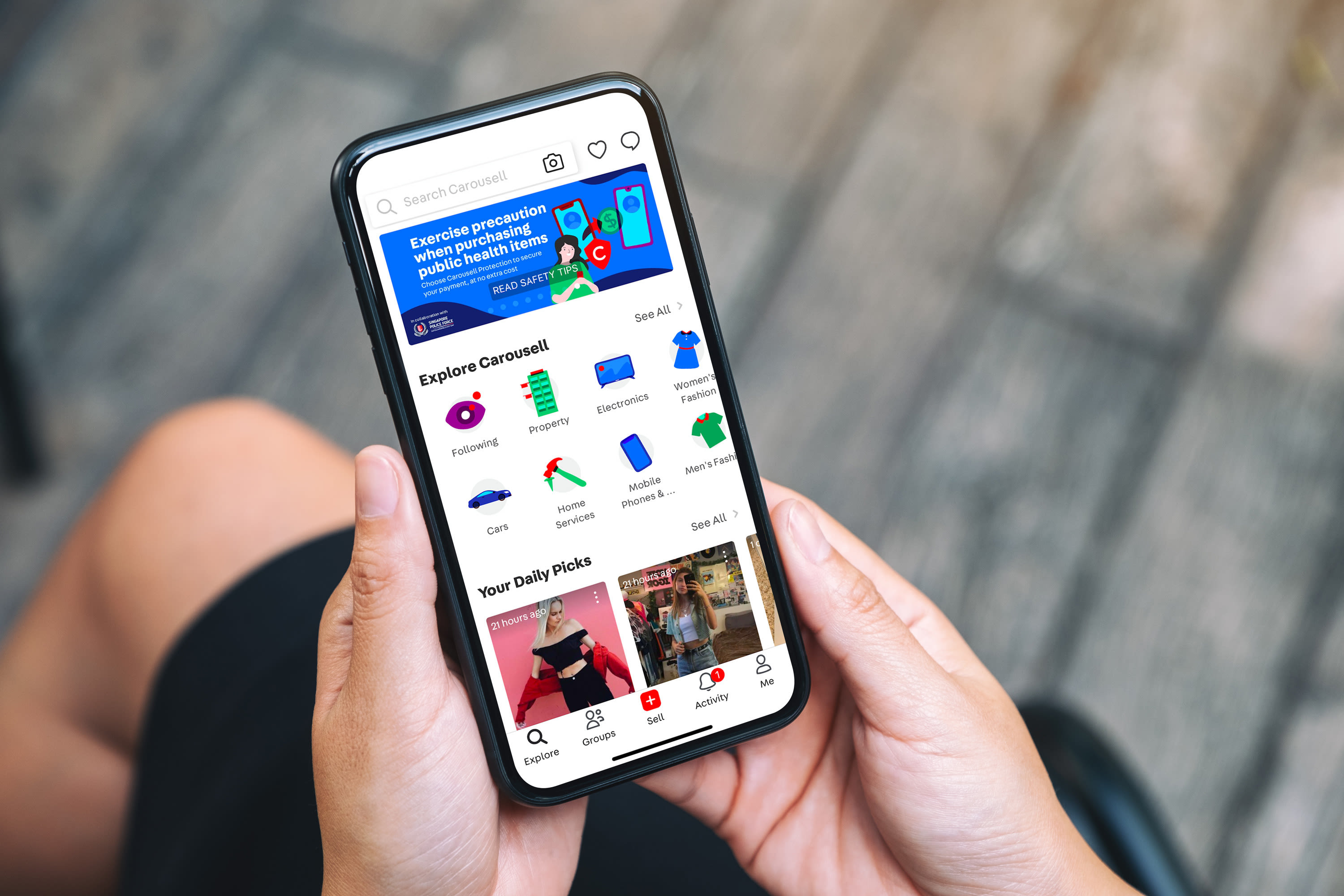

The peer-to-peer marketplace reduced fraud and built trust between users on its way to becoming one of the most valuable tech companies in Southeast Asia.

Peer-to-peer trading in second-hand goods can be risky, especially when it involves valuable items. Buyers interacting with anonymous sellers often have to decide whether to send payment before they know for sure that a lamp works or a luxury bag is legitimate—or whether either will arrive at all.

This is the challenging dynamic that Carousell has addressed on its way to becoming one of the fastest growing marketplaces in Southeast Asia, and one of the region’s rare unicorns. The company started in Singapore in 2012, and is now one of the leading classifieds marketplaces in Asia for tens of millions of monthly active users in Singapore, Malaysia, Hong Kong, Philippines, Taiwan, Indonesia, Myanmar and Vietnam.

Carousell’s rapid growth has been boosted by its partnership with Stripe, which has helped the marketplace build trust between users, control the flow of payments, and weed out fraudulent actors.

Building trust with Carousell Protection

In 2012, Siu Rui Quek, Marcus Tan, and Lucas Ngoo were in their early twenties and fresh off internships in Silicon Valley when they developed the first version of Carousell, during a prominent annual hackathon in Singapore. The three friends imagined the product as a simple, one-stop mobile marketplace for second-hand items that would, as they put it, “inspire every person in the world to start selling.”

After six years of growth, Carousell reached a pivotal moment in 2018. The founders knew that to achieve the scale they wanted, they needed to fix some of the fault lines in the second-hand economy. So, that year they introduced an in-app payment feature called Carousell Protection, aimed at creating a safer and more conducive environment for users.

When a seller and a buyer agree to a transaction, Carousell Protection withholds payment to the seller until the buyer has actually received the item. Once the buyer has acknowledged receipt, the payment is released, without disclosing the buyer’s personal information. This helps create a high-trust environment in which buyers can purchase with confidence, knowing their privacy will be protected.

Behind the scenes, Carousell Protection is based on a pair of Stripe products: Stripe Connect to accept payments and control the flow of funds, and Stripe Radar, which uses machine learning techniques to detect phony sellers and block fraudulent payments.

“Carousell Protection is a great example of the innovation we offer our sellers and buyers to give them peace of mind as they transact easily and safely in our marketplace,” said Lucas Ngoo, cofounder of Carousell. “There’s still more to do and we want to work with partners like Stripe to continuously improve the experience on Carousell in everything from products to payments.”

In the three years since its introduction, transactions using Carousell Protection have more than tripled in Singapore and Malaysia. At the same time, fraud has plummeted, to fewer than three cases out of every 10,000 transactions.

Partnering with Stripe to grow revenue

Carousell has also been busy offering its users new ways to make payments. In October 2020 the marketplace used Stripe’s no-code integration to introduce GrabPay, a popular e-wallet in Southeast Asia. The acceptance of GrabPay opened up another avenue for transactions and boosted Carousell’s sales in Malaysia by 20% during the pandemic.

Carousell sees the flexibility of GrabPay, plus the assurances provided by Carousell Protection, as reshaping the way consumers view the second-hand economy.

“We believe we can create an inversion in commerce by 2030, where first-hand ecommerce will supplement re-commerce as consumers buy something new only when necessary, or after they have sold something. It will ultimately be good for society, and for the planet, when second-hand becomes the first choice,” said Ngoo.