Stripe expands its revenue and finance automation suite to help ambitious companies modernize their finance stacks

- Stripe makes major upgrades to Stripe Billing and Stripe Tax, and launches Stripe Revenue Reporting in beta, to help companies eliminate back-office inefficiencies and support revenue growth.

- New Billing features reduce failed payments and customer churn, and the new Tax API automates sales tax calculation for transactions on and off Stripe.

- Over 250,000 companies, including Atlassian, OpenAI, and Ritchie Bros., now use Stripe’s revenue and finance tools to acquire, collect, report, and grow revenue. Stripe’s automated revenue recovery features earned businesses an extra $3.8 billion in 2022.

SAN FRANCISCO AND DUBLIN—Stripe, a financial infrastructure platform for businesses, today announced the expansion of its revenue and finance automation suite to give businesses power over the entire life cycle of their cash flow. By coordinating billing, tax, reporting, and data services in one modern stack, Stripe’s revenue and finance automation suite eliminates the inefficiencies of legacy finance tools and supports revenue growth.

With the launch of Revenue Reporting, and major upgrades to Stripe Billing and Stripe Tax, Stripe aims to bring the same users-first approach to back-office operations that it brought to payments. The revenue and finance automation suite allows finance teams to get more done in less time, while freeing them to focus on the areas that matter most to their business.

The challenges facing finance leaders

While the internet has been a boon to productivity, the gains have been uneven. Common financial processes like billing, tax, and quarterly reporting are still painfully inefficient and manual. They’re also typically spread across a dozen or more software tools. The result: one-third of finance leaders reopen their books at least once a quarter because of accounting errors, and half spend 10 hours a month manually correcting discrepancies.

Stripe’s suite relieves those burdens by equipping finance leaders with revenue management tools that are as sophisticated as the businesses they run. The suite automates manual work and improves accuracy across the cash flow life cycle, from payments and billing to tax, reporting, and reconciliation.

Fast-growing businesses like OpenAI no longer need to cobble together as many integrations from multiple software providers—a single integration with Stripe works instead. They can start with Stripe for payments or subscriptions; then, as they grow, they can easily switch on other revenue and finance automation products to support work like billing quotes and VAT. Established enterprises like FOX Sports used Stripe Billing to manage its monthly subscription model and add different pricing models, premium experiences, and new payment options for subscribers.

It’s how finance should work for any modern business.

“For years, our users have been asking Stripe to help them run a more efficient finance operation, one plagued by fewer daily frustrations,” said Vivek Sharma, head of revenue and finance automation at Stripe. “We can’t ship them Advil every month, but we can take care of their headaches. Stripe’s revenue and finance automation suite is designed to be a smooth, one-stop shop for forward-thinking finance teams.”

A unified approach to revenue and financial management

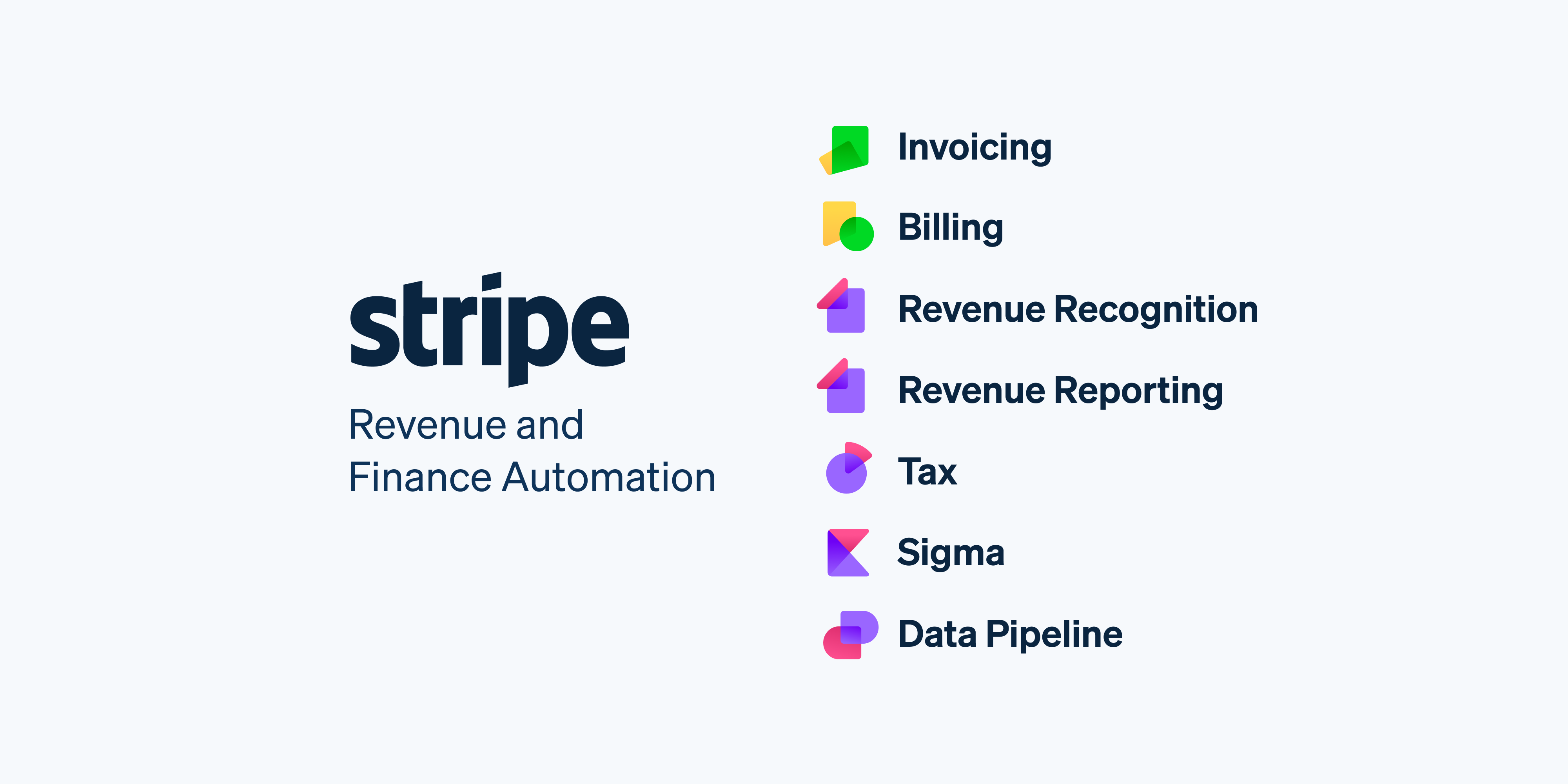

The revenue and finance automation suite includes Billing and Stripe Invoicing for acquiring customers and earning revenue; Stripe Tax, Revenue Recognition, and (as of today) Revenue Reporting for collecting sales tax, reporting revenue, and closing the books; and Stripe Data Pipeline and Stripe Sigma for data analysis.