We regularly invite leaders to share their experience and expertise with the Stripe community. To better understand how Stripe’s BaaS team selects and works with banks, we recently spoke with Gillian Wee, who leads partnerships for Issuing on Stripe’s Financial Partnerships team. In her role, she identifies and establishes relationships with the banking partners that can provide the most value for Stripe users. Then she works with those partners to optimize the value users receive from Stripe BaaS products—from negotiating lower fees to reducing settlement times and more.

In the following interview, Wee talks about the evolving financial services ecosystem. She also touches on what it takes to build a card issuing program, how Stripe’s BaaS products use the financial infrastructure and banking relationships Stripe has been building for more than a decade, and why redundancy in bank partners is so important.

The mission of Stripe BaaS

Until recently, the only way to access financial services was at a bank. If you needed to open a checking account, you went to a bank. If you wanted to apply for a loan, you went to a bank.

But today, financial services are accessible in more places than ever before, with even more of these services being offered online, whether it’s through a neobank; a software platform; or buy now, pay later (BNPL) financing. These innovations comprise the fintech revolution—and they’re rewiring the financial services industry.

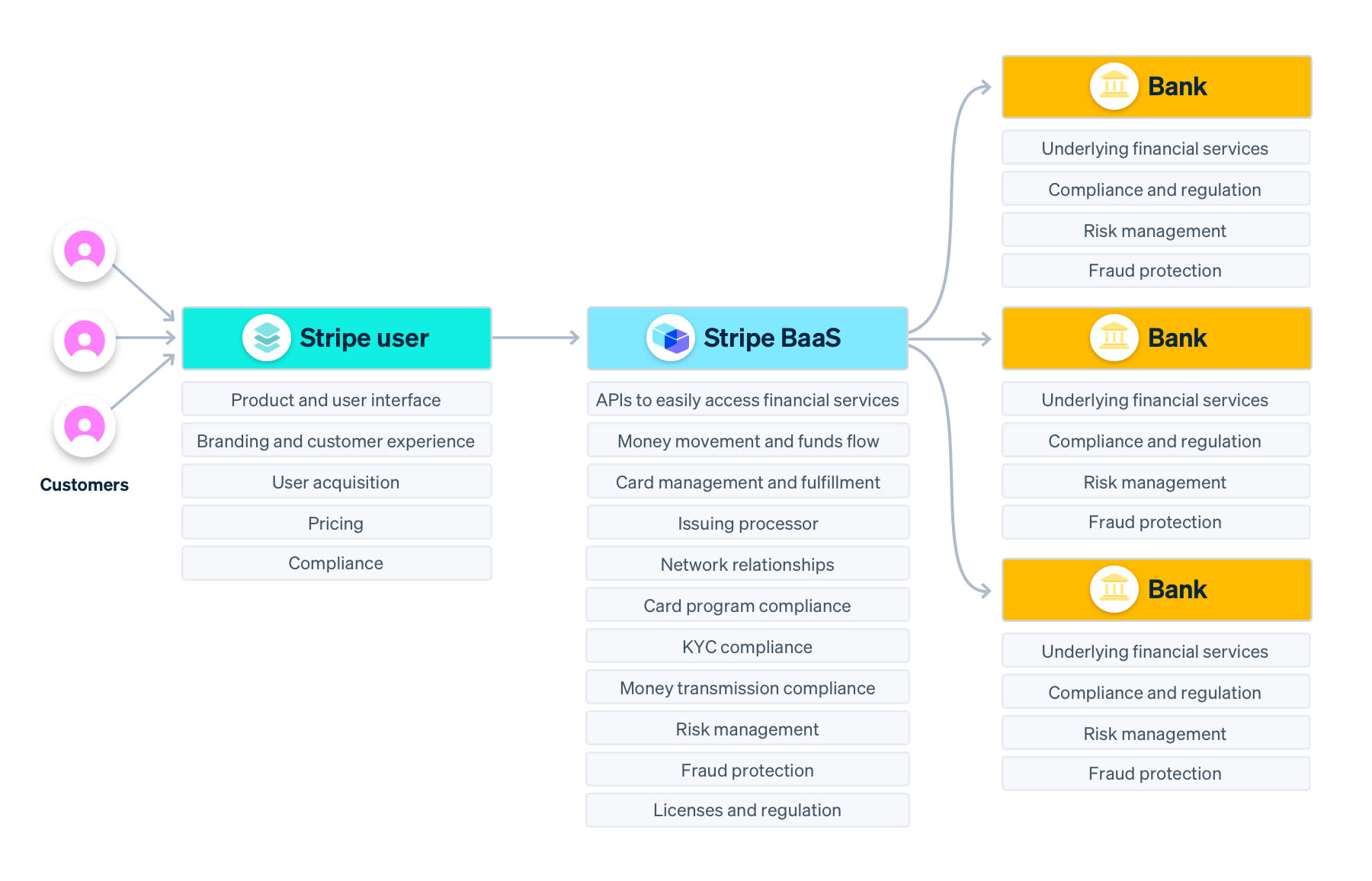

The mission of the Stripe banking-as-a-service (BaaS) team is to make it possible for every business to become a fintech business. Stripe’s BaaS offerings allow platforms to offer direct access to financial services within products that their customers already know and trust. These include Issuing, which powers commercial cards, Treasury, which enables financial accounts, and Capital, which facilitates friction-free financing.

For Stripe users, these products hide a lot of the complexity of providing financial services. But behind the scenes that complexity still exists, and the Stripe BaaS team partners with banks to navigate it—so Stripe users don’t have to.

Why bank partnerships are important to Stripe BaaS

Banks provide key financial infrastructure, and our partnerships with them help us bring our products to market safely and compliantly. For example, our US banking partners for BaaS are regulated and closely supervised on an ongoing basis by the FDIC, the Federal Reserve Board, and various banking regulators. We partner with our banks closely on a range of important topics, including compliance, risk, reporting, marketing, disputes, and contracts, so our BaaS users don’t have to. Our technical products are built on top of these bank partnerships, so our users benefit from a bank’s infrastructure via Stripe’s BaaS products.

In parallel, in order to offer our BaaS services, Stripe maintains nearly 80 national and regional licenses around the world, under which we’re directly subject to regulation and ongoing supervision by dozens of regulatory agencies. This allows our users to expand globally without incurring any additional regulatory burden, because Stripe BaaS takes care of it for them.

Stripe BaaS

Stripe Issuing’s unique approach to bank partnerships

A lot of BaaS providers are just focused on BaaS, while our products are obviously part of Stripe, which is invaluable when it comes to partnerships. Stripe has built a durable structure for financial partnerships and compliance to satisfy global regulations and provide the most streamlined, reliable, and safe financial solutions to users, and we work closely with some of the world’s most reputable and innovative banks worldwide. And often, we’re able to use those relationships for our BaaS products.

As an example, we recently signed a deal with a new bank sponsor who is already supporting Stripe outside of our BaaS products. Because we had that pre-established, mutual comfort across a variety of fronts, we were able to evaluate and sign the bank in record time.

Across Stripe, we have several large and experienced teams who manage these financial relationships, so we’re lucky to have economies of scale across our Stripe products, which is pretty unique. And that goes for multiple teams that work on just our BaaS products too, including legal, compliance, and regulatory teams with deep industry and government experience.

What Stripe Issuing looks for in bank partners

On the payments side of the house, Stripe has a long history of partnering with leading firms whose services enable our users to thrive. We’ve spent years becoming experts on the intricacies of banking and money movement and have built a ton of innovative products in partnership with many trusted institutions.

When we select a bank partner for BaaS, we begin by evaluating the bank’s ability to support a range of users’ needs. We look at its product and compliance standards, regulatory experience, sophistication with technology, and ability to scale both in terms of the number of businesses it can support and how fast those businesses grow.

The bank partners we select—and the maintenance of those partnerships—are key to our BaaS business, but more importantly, they’re key to our users. We’ve established rigorous frameworks, not only to select our bank partners, but also to continually assess our relationships so that they’re durable. And, reciprocally, our bank partners provide ongoing assessments of Stripe with our regulatory, compliance, and financial crimes teams. It’s a two-way partnership.

Redundancy as a core focus

Redundancy mitigates dependency on any one partner, and most importantly, minimizes the likelihood of our BaaS users experiencing business disruptions. Issuing, Capital, and Treasury partner with a variety of banks, ranging from smaller, tech-forward players to larger global financial institutions.

Since we support a lot of different use cases on Issuing, such as expense cards, fleet cards, or B2B payments, having a variety of bank partners helps us determine which one best suits a user’s needs.

For example, if a startup comes to us and says they want to build a new expense management solution, it’s a quick approval process because that’s a straightforward use case we’ve already sorted out with our bank partners. If a business comes to us with a unique use case we haven’t seen before, we evaluate it on a 1:1 basis with a relevant bank partner or even with multiple bank partners.

Basically, having multiple bank partners lets us prioritize speed and compliance. We know how important it is to move quickly—and we believe compliance is the bedrock of a successful fintech company. We work to balance both principles with our partners.

The challenges of building a card issuing program from scratch

To build a card issuing program from scratch, it takes several months to a year to find at least one bank sponsor or get a network license, set up the program, figure out card printing, and establish a compliance program. This is hard for an established business, let alone a startup. And as card programs grow and expand, they only get more complex.

Stripe Issuing does all of this via integrations with our partners, so users can issue their first card in a matter of minutes. Like a lot of Stripe products, we remove complexity for our users so they can get to market faster and focus on their core products. The next business that builds on us benefits not only from our program, but also from the experience we have supporting all of our existing users, who operate at scale across 20 countries.

Supporting Stripe’s ambitions to grow beyond payments

Stripe’s mission is to increase the GDP of the internet, which means building financial infrastructure to support online commerce. This includes investments not only in global payments but also revenue and financial-management products, as well as BaaS products. I’m proud that Stripe BaaS has a proven track record of supporting a healthy range of users, from scrappy startups to large enterprises, and I’m excited to see where we go from here.