We regularly invite leading entrepreneurs and investors to share their experience and expertise with the Stripe Atlas Community. Andrew Chen is a general partner at Andreessen Horowitz, where he invests in consumer startups. Previously, he led rider growth at Uber, focusing on acquisition, new user experience, churn, notifications, and email.

Why marketplaces

Andrew Chen has a good reason to be bullish on marketplaces. Soon after joining Uber’s growth team, the company hit its highest growth rate in years. At the time, it had signed up over a hundred million people and spent nearly $1B on its growth efforts annually. While it took the company five and a half years to hit a billion trips, it tallied its two billionth ride six months later. This acceleration and scale would motivate any professional, but it made him as compelled by marketplaces as a category as it did by Uber as a business. In his first major post after joining Uber, Chen reflected:

From a UX experience, Uber is ‘hit a button and a car comes,’ but from a business standpoint, it’s a vast collection of hundreds of hyperlocal marketplaces in nearly 70 countries. Each marketplace is two-sided, with riders and drivers, has its own network effects driven by pickup times, coverage density, and utilization.

Years later, Chen counts himself as an investor, advisor, and continued student of marketplaces. “Over the last decade, many of the most successful companies—Airbnb, Uber, Etsy—have been marketplaces. And if you look at the overall category, there’s also eBay and companies that have evolved into marketplaces like Amazon,” says Chen. “Marketplaces are the single most compelling sector over the last few decades and among the best since the internet began. I know that sets high expectations, but, as a category, marketplaces can—and have—hit the bar.”

Chen has written extensively about marketplaces and one trait that makes them especially powerful: network effects. This is the phenomenon that the network becomes more valuable to users as more people use it. As many startups prove, network effects aren’t exclusive to online marketplaces, but, as a business model, marketplaces inherently have more levers built in to drive network effects. According to Chen, there are four network effects levers that are core to marketplaces:

- Product promotion = marketplace promotion: “At its most basic, a marketplace is an online platform that allows sellers and buyers of goods and services to connect and transact. Whether you sell Pez dispensers or gardening services on a marketplace, you’re marketing where you’re selling as much as what you’re selling,” says Chen. “In other words, from a user-acquisition standpoint, sellers are incentivized to widely promote that they’re using the platform. In the process, marketplaces create a viral loop that generates free, organic traffic.”

- Shared experiences > same experiences: Say you use a smartphone. You may have the same product experience as billions of other people, but it’s not a shared experience. “Marketplaces allow you to experience the marketplace product right along with other users. Network effects generally become stronger the more the product or service is experienced at the same time and in the same place,” says Chen. “Homesharing and ride-sharing are perfect examples. If you’re taking a car or renting a home with a friend, you not only have experienced the product, but also experienced the product together. The relationship with a marketplace merges with the relationship with the friend. This is one flavor of network effects that becomes really enduring for marketplaces.”

- Shared experiences > owned experiences: “Marketplaces are built on the fact that many items that we own are underutilized. At the core of that principle is the belief that those items are better shared than just owned for yourself,” say Chen. “For example, there’s a company called Hipcamp that helps outdoorsy people find campsites not only in public parks, but also on private land. By owning property, land owners have costs, from taxes to maintenance. By making their owned asset a shared one, they can realize more value from the land by sharing it with people who’ll enjoy and respect it.”

- More users, better product: “For many companies, there can be a hit to quality as more users join. It can be more difficult to adapt to more volume and use cases. But marketplaces are the rare kind of businesses where the more people use the product, the better the actual experiences,” says Chen. “Take Wonderschool, a marketplace of daycares. The more daycares there are, the more parents can find options that hit the mark for variety—like Montessori or language-immersion—and proximity to their homes. Parents become more excited and engaged with the service, which helps the daycare find and acquire more customers.”

Most underrated aspect of marketplaces

For Chen, the most underrated feature of marketplaces is their ability to facilitate services. “As an industry, tech has done well getting things from point A to point B. Users on Amazon, eBay, and Shopify can get a product to your house in a week, a day, or sometimes real time,” says Chen. “Where marketplaces haven’t been—but should be—great is facilitating services. When it’s time to find a nanny for our kids or an executive coach to hire, we still mostly ask friends and colleagues for referrals. Yet, marketplaces are well outfitted to facilitate services because of how they can help standardize experiences—in some cases to the point of productizing them. We’ve seen marketplaces help strangers share homes and cars, but that’s not true of all services yet.”

“Most marketplaces will need to change their strategy to get there. When they do, they’ll tap into a huge global market, one that’s a multi-trillion-dollar segment in the US economy alone. To do so, marketplaces should address users’ expectations of quality and trust. But what does that really mean?” says Chen. “Quality and trust come with consistency. On the buyer side, that includes creating a comprehensive ontology of all offerings, having insurance policies, providing training to sellers, and creating levels of services. On the seller side, that involves equipping sellers as small businesses. Users now build entire businesses off of marketplaces, and they need to do increasingly more on them. Marketplaces must help sellers price products and services, train and manage workforces, get tooling to find vendors, and implement CRMs to manage leads.”

Marketplaces develop a deeply symbiotic relationship with the businesses built on top of them. “Take a fast-food burger chain listed on Uber Eats. On its own, it might rely on foot traffic, local advertising, or word of mouth. But the world is changing. The number of food delivery app downloads is up nearly 400% compared to three years ago. This trend is transforming how restaurants get revenue and even how they’re designed,” says Chen. “If that burger chain weren’t on a marketplace like Eats, it’d need to become an expert in developing an app and getting users to download that app—all to grow beyond a local base of recurring customers. But on a marketplace, the burger chain can serve a wider audience. For example, it can intercept users who might be hungry for pizza or falafel and convince them to get burgers instead.”

It’s not only restaurants that benefit from this relationship. “Marketplaces like Eats heavily depend on restaurants that are highly professional and operational and that already have a brand on their own. These restaurants are frequently the ones people prefer to order from the most and are at the ‘head’ of the power law curve,” says Chen. “Food delivery is only one example, but the same dynamics have played out in everything from short-term stays—with marketplaces like Sonder and Lyric—to local service businesses that list on Thumbtack or Care.com. The bond between marketplaces and their professional supply is one of the most mutually beneficial relationships in all of the tech industry.”

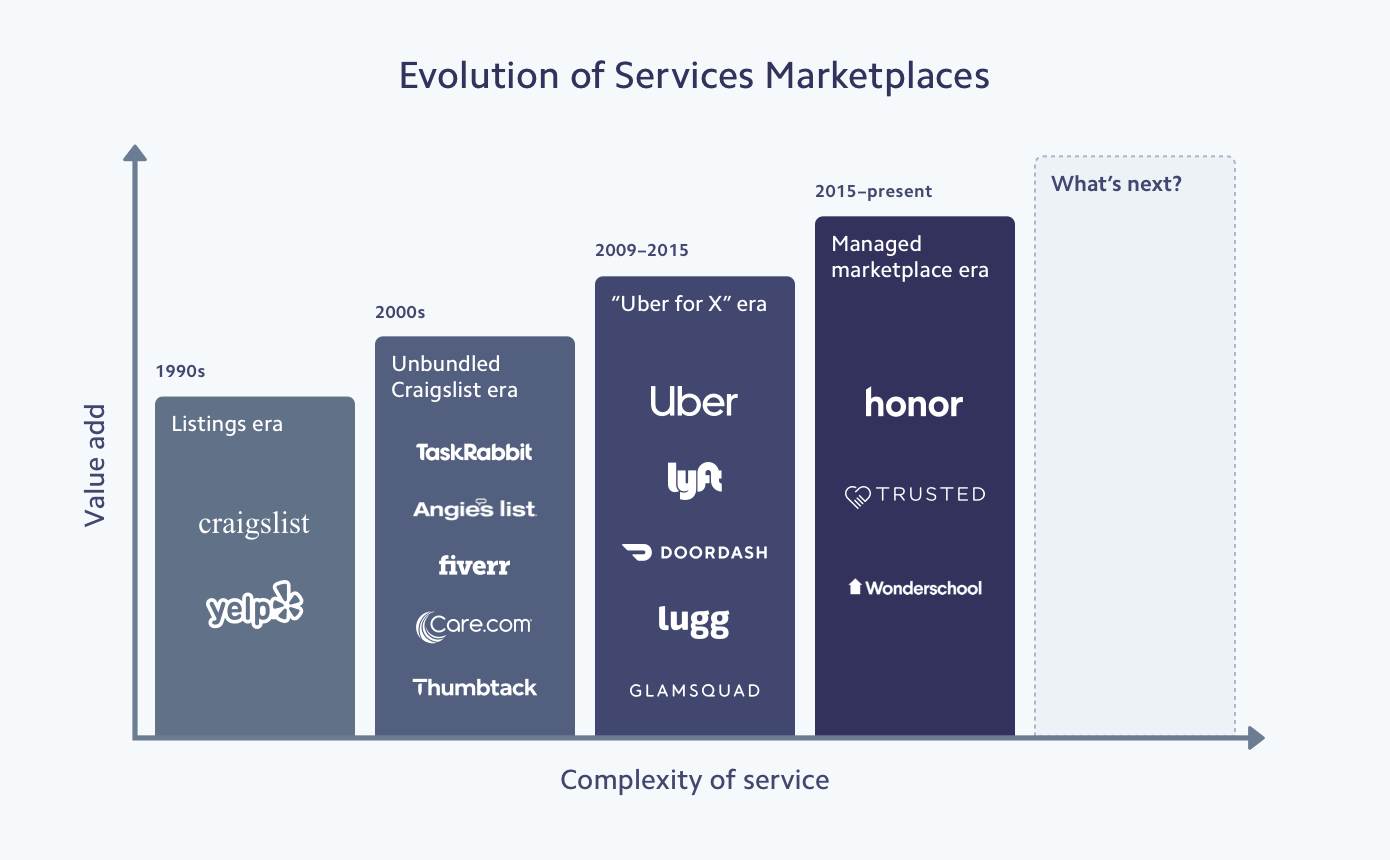

According to Chen, the leap to facilitating services is not only an opportunity for marketplaces, but also an eventuality. “There’s still a longstanding belief that most marketplaces are just souped-up versions of Craigslist categories. That, to build a marketplace, a company just needs to take a Craigslist category and make it better. That may have been true a decade ago, but that has changed,” says Chen. “As an investor, the marketplaces I get excited about are the ones where founders take a licensed profession from the service economy and build a marketplace around it. It’s not just a nice-looking listing that a seller posts and a buyer clicks on. Perhaps there’s a video to help users understand and visualize the service they’re about to get. Or a rating system that gets deeper than the 1–5 stars system that we all know. I think that this type of evolution toward services is an underappreciated aspect of building out a marketplace that doesn’t get the love on blogs or Twitter but is one of the key ingredients.”

Content from chart courtesy of Andrew Chen and Li Jin.

Most overhyped aspect of marketplaces

At the heart of “Uber for X” company pitches is the most overrated part of marketplaces: the overriding belief that one marketplace strategy cleanly translates across all marketplaces. “There have been billions lost for people who described their business as ‘Uber for another industry or market.’ It's a sticky way to describe a company, but it rarely translates to standout marketplaces,” says Chen. “Groceries. Ride-share. Home rental. There have been successes in those categories. But the flip side is also true. On-demand massages or valets don’t quite hit the same marketplace sweet spot. You can’t port over the strategy from one marketplace to another without understanding the fundamentals of why those mechanics worked.”

Repurposing a playbook from another business is a risk for any type of company, but Chen sees it happen more frequently—and egregiously—with marketplaces. “Let’s take two examples related to vehicles: ride-sharing and valeting. It turns out that ride-sharing works well as an on-demand marketplace because it’s a service you can choose and use nearly every day. And not only for commutes but generally getting from point A to point B. This increases the liquidity of the marketplace,” says Chen. “On the other hand, valeting is limited to car owners or renters, a much smaller market than riders. Also, you’ll likely valet twice a day: at drop-off and pick-up. From the supply side, people will not be able to support themselves as full-time valets.”

The bottom line is that many people like to group marketplaces as a sector, when in fact they are more distinct than similar, according to Chen. “There’s a lot of nuance with marketplaces. But whenever there’s a hot company or category, most try to apply all the patterns to see what comes out at the other end. Sometimes it works, but most times it doesn’t,” he says. “Marketplaces don’t constitute a sector the way gaming might. Marketplaces can span the hotel industry to the transportation sector to education to recreation. They each belong to distinct industries that don’t easily accommodate a one-size-fits-all marketplace strategy.”

Cracking cold-start by outmaneuvering Metcalfe’s Law

One of the greatest challenges of marketplaces is how to grow a network—and where to begin. It’s often called the cold-start problem. “If you remember your dot com bubble history, a lot of the early moves in tech were attributed to something called Metcalfe’s Law. It holds that, as you add more nodes to a network, the number of interconnections rapidly increases,” says Chen. “If you graph that, it looks like this crazy exponential growth curve. It suggests that there’s a first mover advantage, because if you move quickly and get the nodes before anybody else, your network’s going to be better. The dynamics of this law have become standard business advice and part of the startup lexicon.”

The problem is that’s not what actually happens. “Anyone working in the world of startups and marketplaces knows that this is not how it works at all,” says Chen. “When your network is somewhere between zero and the density or size of network required for escape velocity, your network wants to self-destruct constantly. If you’re not adding new users—either buyers or sellers—your network wants to go to zero. Your buyers show up and don’t see enough to buy. Your sellers don’t see anyone bidding and decide to move shop. Until you get to the escape velocity of your network, you’re battling anti-network effects.”

According to Chen, there are many clever ways that founders have cracked the cold-start problem and successfully escaped the entropy of early networks. Here are three examples:

Come for the tool; stay for the network. “Hipcamp started out as a way to find public campgrounds. They collected and indexed camping sites, so people could find them in one place. It compiled existing lists, so the aggregation of the supply side wasn’t a heavy lift,” says Chen. “This allowed Hipcamp to be useful as a buyer-side tool from day one, even if it wasn’t useful as a marketplace from the start. Once it proved a useful tool, the demand side—campers—showed up, and Hipcamp could double down on a booking functionality. Then it started deepening the supply side, signing up private campgrounds and property.”

Chen credits fellow investor Chris Dixon with naming this technique. “OpenTable is another famous example of this approach to cold-start. OpenTable started on the seller side, as a tool to help restaurants manage tables, and then it started to drive demand. Hipcamp is a better example of a buyer-side tool that then advanced supply as a result,” says Chen. “There are many other examples, but the strategy is to create an inventory management tool as an interim step to building a marketplace. A lot of times, it starts on the seller side.”

Digitize pen-and-paper experiences. “Pietra is a custom jewelry marketplace. A few Uber alumni started the company and so are familiar with supply- and demand-side dynamics. Their idea is that getting expensive jewelry—from a product and buying experience—is outdated, particularly for the millennial set. First, it’s discovered differently, likely from Instagram celebrities or makers streaming about their jewelry. And second, the jewelry is not personalized or customized. You might like a bracelet design but want your birthstone or an engraving,” says Chen. “Pietra is building a two-sided marketplace—or three-sided if you include influencers—of customers and thousands of very small-shop, mom-and-pop jewelers.”

These smaller jewelry shops can often do custom jewelry at better rates than larger chains, but their back office is not always efficient. “There’s a lot of back-and-forth that can come with preferences around style, sizing, and purchasing. Pietra consolidates and stores those specs in an app with a nice interface. That way a small jeweler who might be working with 50 potential customers doesn’t miss or lose information,” say Chen. “It makes the process easier for jewelers, as well as customers. And, from a business model perspective, with all the customer’s preferences in one place, there’s a barrier to switching to another marketplace.”

Establish a minimum guarantee for the supply side. “A lot of marketplaces—especially in the service economy subset—can benefit from starting with a guaranteed base rate of pay early on. For example, Uber might promise $25/hour if a driver completes a minimum of trips in a day. This predictability not only brings more stability to those on the supply side, but helps the business build up the supply side quickly,” says Chen. “With that volume on the supply side, you get enough momentum to set up the demand side. Then once the demand side’s building, more sign up on the supply side. Now, the flywheel’s going. As the market reaches liquidity, the earnings of the supply side—say, Uber drivers—will start to close in on the guarantee such that, eventually, the market naturally supports the guarantee.”

This is a powerful technique given how many marketplaces struggle with supply. “I think almost all the best marketplace companies end up being supply constrained as opposed to demand constrained. Whether it’s education, groceries, or elder care, there’s basically unlimited demand, as you can keep price parity with everything else,” says Chen. “And so, what tends to happen is you end up spending a lot of your time thinking about the supply side. I noticed this at Uber. When you’re launching city by city, you find yourself really focused on the supply side of your market—and the same challenges and ideas keep showing up over and over again.”

Supply-demand-supply-supply-supply vs. demand-supply-demand-demand-demand

Every marketplace must assess the relative density of supply and demand, and which one networks better. Chen has observed a pattern for C2C, B2B, and B2C companies. It comes down to which side is going to experience higher friction at sign-up, which often corresponds to which side is going to be doing more work.

C2C and B2C: “In a consumer marketplace like ride-sharing, a driver is working multiple hours per day, while riders might spend 15–20 minutes in a car. Or if you’re a childcare and preschool services marketplace like Wonderschool, the businesses have to get licensed, while families mostly need to sign up to participate,” says Chen. “With these marketplaces, the challenge tends to be if you can get enough supply to participate, because they must do more work to join. So with consumer-oriented startups, start with supply, and then demand. Then double down to focus on supply, supply, supply.”

B2B: “The winning equation for B2B marketplaces is the reverse. Take trucking companies like Convoy or a warehousing marketplace like Flexe. These types of businesses tend to be more demand constrained, because your demand side is likely Fortune 500 companies. The demand side is less concerned with pricing and more on quality and reputation. The sales cycle is long. Marketplace startups will approach these corporations, offer a service, and get LOIs. They’ll use those to raise funding and nail the supply side. And then go back to selling into the Fortune 500,” says Chen. “Compare this to consumer marketplaces, where consumers are price sensitive. In that case, if you ever have too much supply, you can always cut prices, and demand will skyrocket. And then you can rebalance your marketplace. But it’s the reverse with B2B marketplaces. The order of focus ends up being demand, supply, demand, demand, demand.”

Caveats: Of course, these patterns are rules of thumb; there are other elements at play. “There’s seasonality and region. For example, Las Vegas was often oversupplied for ride-share because there are more drivers—and a lot of riders would take taxis. While in San Francisco or New York, ride-sharing was more supply constrained. The same happens with home rentals. Airbnb will be very supply constrained during the peak travel season—like the summer—but oversupplied other times of the year,” says Chen. “Then there’s other factors. How easy is it for somebody to participate in the marketplace? For example, do you need to own a house to participate? Do you have to get a license? About 25% of the US workforce operates under some licensed profession. These factors cause can cause friction with supply-demand dynamics.”

Post-escape-velocity leaks in supply and demand

Even as marketplaces get traction, they must contend with leaks on their supply and demand side. “Let’s go back to Pietra, the jewelry marketplace. That’s a great example of this dynamic where the demand side just doesn’t necessarily buy all that often. Right? Hopefully you’re not buying more than one engagement ring,” says Chen. “If you’re going to get people to buy for themselves, that can happen more frequently, but will probably align with a special occasion. That’s where you might find the demand side isn’t leaky, but just inactive.”

The goal then is to reacquire or reactivate them. “If it appears that there’s a leak on the demand side, that’s probably okay if it’s just people going in and out of activity. As long as the business has a great scalable, cheap way to acquire users, it’ll be okay. For some, that might be through SEO, allowing people to find the company,” says Chen. “On the other side of the equation—the supply side—ideally, you’re providing so much work and earnings that they’re very happy with it, and extremely sticky. After looking at many marketplaces over the years, I’ve found that you want at least one side to be sticky. It’s not always the demand or supply side, but it must be one of them at any point. That way, you can always lower prices on the supply side, which will make it less sticky for them, but grow usage and frequency on the demand side.”

Even the mature marketplaces find ways to mitigate leaks in supply and demand. “I think in the first seven years of Uber’s existence, there was a price cut every January. It was in the system to counteract any leaks. That cut would grow the market each year until we reached a point where everyone was fully utilized and cutting wouldn’t increase utilization anymore,” says Chen. “So going back to Pietra with this perspective in mind: I wouldn’t worry about the demand side being intermittent. It’s great if you can figure out how to guide people from engagement rings to birthdays to other kinds of moments to buy jewelry. But what I’d really look at is: Are the jewelers happy? How much of their business is being driven by the marketplace? Can they basically support themselves by just being Pietra participants? That’s what I’m most interested in.”

Ideas behind the next big marketplaces

Chen is eager to see new permutations of marketplaces take shape. Here are three ideas that he believes will drive these new types of marketplaces forward.

Everyone can do something they love and be paid for it. “The ideal for society is that everyone can do something they love and be paid for it. If that’s finding an audience with writing or blogging, there’s Substack. If it’s making, there’s Patreon. If it’s teaching kids, there’s VIPKid. If it’s getting people outdoors, there’s Hipcamp,” says Chen. “These marketplaces are a different cut than transporting food or people. They are marketplaces that are redefining the future of what work looks like. I think more of these industries will end up being a collection of marketplaces versus led by centralized companies that are employers.”

Licensing is not the only way to ensure quality. “Licensing made sense in a world where governments had to ensure the quality for everything. But it’s causing a big problem for a bigger portion of our economy. It makes it so much harder for people—especially hourly workers—to get jobs,” says Chen. “A recent New York Times article showed how many licenses, such as in cosmetology, require dozens of hours in schools and get people tens of thousands of dollars in debt. Then they work at a salon making minimum wage. It’s the beginning of a crisis. There’s an opportunity for marketplaces to use software, ratings, and reviews to create transparency, so that people can find work, potentially, without the arduous licensing process.”

The software layer for marketplaces is table stakes. “There’s a rise in marketplaces that goes beyond digitally connecting supply and demand—they’re actively creating trust between them. These full-stack ‘managed marketplaces’ are proactively elevating the customer experience for every side of a marketplace,” says Chen. “For example, Honor is a managed marketplace for in-home care. It doesn’t just list a roster of care providers for people to discover and hire. Honor interviews and screens each care professional before they onboard. It connects customers with advisors to design personalized care plans. Honor has agency when it comes to defining the customer experience for each side of the marketplace and in building trust between them.”

Marketplaces fully realized

Chen helps marketplaces clear the cold-start hurdle, because then companies have the chance to unlock big opportunities as they scale. “Uber taught me what growth truly looks like. During my time there, it was very much post-product/market fit. The operation was moving quickly—and my role was to figure out how to get it to go even faster. We had weeks when we’d onboard over 200 new employees. We were signing up over 3% of the world’s population annually,” says Chen. “But the possibility for this type of growth is dormant until marketplaces crack the cold-start problem. Only then does a flywheel become a windmill—one that can power and sustain a business.”

Read about how marketplaces use Stripe or check out Stripe Sessions to hear Chen’s fellow Andreessen Horowitz partner and former CEO of OpenTable, Jeff Jordan, talk about how innovative marketplaces are creating differentiated experiences for sellers.