Whether platforms want to improve the stickiness of their product or are interested in opening up a new revenue stream, offering charge cards can be a compelling part of their business. With a charge card program, account holders can spend ahead of available funds and then repay the platform after the funds have been spent.

While charge cards sound great on paper, building a program can be challenging. Platforms need to think about how to fund the cards, collect repayments, handle lending compliance, and more. Luckily, banking-as-a-service (BaaS) providers like Stripe are able to help.

At the highest level, BaaS providers extend the infrastructure and logistics of a charge card program to platforms like fintechs and software companies. Platforms then use the underlying BaaS infrastructure to offer charge cards to their customers. For example, Stripe Issuing has a charge card program that Ramp uses to offer charge cards to its business customers. Platforms often want to offer charge cards as part of their expense management solution, since charge cards enable their customers to spend on a line of credit.

This guide explains what charge cards are, why they’re useful, and what to consider when choosing a charge card program. This guide is meant for platforms in the United States, serving US-based customers, since the financial services and products covered work differently in Europe and Asia Pacific.

The below is for general information and education purposes and is based on Stripe’s experience and market observations. This guide does not constitute legal advice, and you should check with your counsel regarding your own unique circumstances before offering charge cards to your customers.

What is a charge card?

Charge cards are conceptually similar to a credit card—they allow account owners to spend ahead of available funds and then repay a platform after the funds have been spent. In other words, both cards enable the account owners to spend on a line of credit.

However, there are two key differences between a charge card and a credit card. With a charge card: 1) cardholders can’t roll over a balance at the end of a payment term, and 2) cardholders can’t accumulate interest on unpaid balances. Charge cards must be paid in full at the end of a payment term. If a cardholder doesn’t pay the full balance when due, they may incur a late payment fee or another form of penalty.

Charge cards are also different from prepaid or debit cards. Prepaid and debit cards are always attached to an account that holds funds. With a prepaid or debit card, the account owner can only spend up to the amount of funds stored in the account associated with the card. Because of this, account owners aren’t able to accrue expenses and pay them back later. There must be enough stored funds readily available on the card for a successful transaction.

Most platforms use BaaS infrastructure to offer either charge cards or prepaid/debit cards.

|

クレジットカード

|

支払いカード

|

クレジットカードまたはデビットカード

|

|

|---|---|---|---|

|

仕組み

|

カード保有者は信用限度枠内で支出することができます。 | カード保有者は信用限度枠内で支出することができます。 | カード保有者はすぐに利用可能な保管金の範囲内で支出することができます。 |

|

返済

|

取引発生後に返済を行います。利息を適用して返済を次の支払いに繰り越すことができます。 | 取引発生後に返済を行います。返済を次の支払いに繰り越すことはできません。 | 該当なし。返済はありません。カード保有者が利用可能な金額を超えて支出することはできません。 |

How a charge card program works

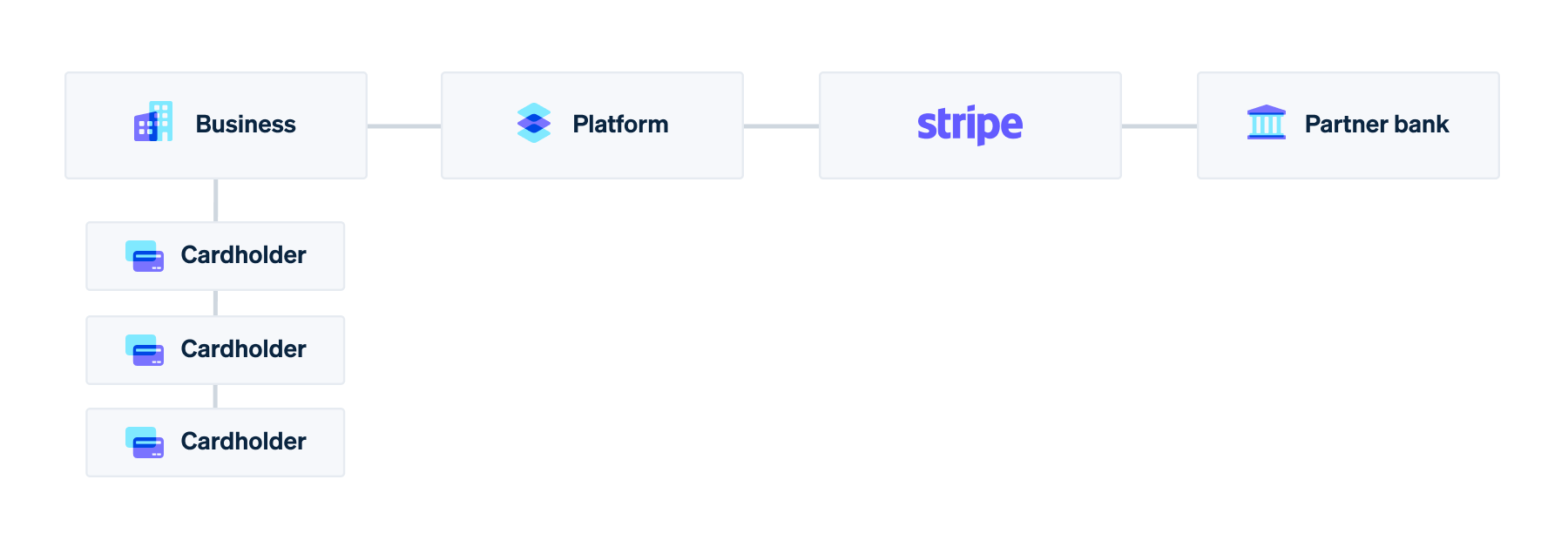

Before diving into the details of offering charge cards, it’s helpful to have a high-level understanding of how a BaaS charge card program works and which entities are involved.

- Cardholder: The person at the business who uses the card to make purchases on behalf of the business. There may be one or many cardholders for each business. For example, if you work with sole proprietors who run their businesses independently, there’s likely only one cardholder for each business—the business owner. If you work with small businesses with multiple employees, they may have multiple cardholders who need a card for business purchases.

- Business: The platform’s customer and the card account owner. The business uses the platform’s software, and the platform offers the business access to cards as part of its product. Businesses can spend up to a certain credit limit, which is determined by the underwriting criteria.1

- Platform: The company that wants to offer its businesses access to cards. The platform could be a fintech company, a software platform (e.g., a vertical SaaS company) , or another type of company. The platform works with the BaaS provider to create a card offering for its business customers.

- BaaS provider: A nonbank (e.g., Stripe) that works with the partner bank(s) to build card programs that platforms use. The BaaS provider authorizes or declines transactions on behalf of the partner bank, maintains the system of record for cardholder data, and communicates settlements with the networks. Its compliance teams work with platforms to implement the partner bank’s compliance requirements and regularly monitor platforms for ongoing compliance.

- Partner bank: A federal- or state-chartered bank. One BaaS provider may work with several partner banks for its programs, and depending on how a BaaS charge card program is structured, the partner bank provides one or both of these services:

- Issuing payment cards (such as credit, debit, or prepaid cards) as a member of the card networks

- Originating credit for the business account owner and defining the compliance requirements that are implemented and monitored by BaaS providers

- Issuing payment cards (such as credit, debit, or prepaid cards) as a member of the card networks

Note, some platforms may choose to work directly with a partner bank and bypass a BaaS provider. See Best practices for lending programs for more information.

Benefits of offering charge cards

In general, there are several benefits to offering cards to your customers, whether they’re prepaid or extending credit:

- Earn interchange revenue: Every time a cardholder makes a purchase with a card issued through your card offering, you can earn money by keeping a portion of interchange, a cost that accompanies every card transaction. Platforms can choose to share a portion of their earned interchange revenue with their customers in the form of points, “cash back,” or other rewards.

- Access transaction insights: Platforms have access to spend data, which gives them proprietary information such as recurring-expense deadlines and growth trends. Spend management platforms, such as Ramp, use card transaction data to give their customers insights into their own spending trends and show them opportunities to cut costs.

- Create a new product offering: If cards aren’t part of your core product, you can offer them as a way to enhance your product suite. For example, a software platform that offers appointment software and payment processing for salons and barbershops might add charge cards as a way for businesses to manage their expenses. Learn more.

When you offer charge cards specifically, there are additional benefits:

- Extend access to working capital: Getting a charge card or a credit card can sometimes be onerous and can involve capital, cosigners, or robust financial statements. In fact, many startup or small business owners have to personally guarantee initial company spend. In a Stripe survey of startup owners, 22% said they would “prefer to use a business credit card” instead of a personal card.2 Platforms can fill this gap by providing working capital directly to businesses.

- Build a tailored lending offer: Platforms have a complete understanding of a business’s financial history based on the payments they process, and they inherently understand the business trends and typical capital needs for the specific industry they serve, whether that’s preseed startups or local beauty institutions. When platforms pair these insights with the infrastructure of a BaaS provider and its partner bank, they can give their users a tailored financial experience.

Build your charge card offering

Before offering charge cards, there are two key decisions you will need to make, which can impact your speed to market and user experience: how to set up lending and how to collect repayment.

Best practices for lending programs

Regulatory requirements can be difficult to comply with, and this is especially true for charge cards, where there is a lending component.

It’s important to set up any charge-card offering to extend credit in accordance with applicable laws and regulations. Compliance is essential to building a fintech platform: fail to get it right, and—at best—you could be faced with large fines that could hurt your company. At worst, your company could be shut down.

Typically, platforms set up lending in one of the following ways, but make sure to consult with your lawyer for your use case.

- Obtain lending licenses: Financial services licenses, such as lending licenses, are permits to perform certain limited activities normally reserved for institutions with a bank charter, and a platform could offer credit directly by obtaining lending licenses in states that require them.3 Obtaining these licenses is generally a resource-intensive effort in terms of time and money. The platform is subject to federal lending regulations, as well as oversight by state regulators.

- Working directly with a bank: With this option, the platform partners directly with a bank to fund loans, allowing the bank to become the lender of record and integrating directly with the bank’s APIs. The platform then distributes cards via the bank or a separate partner, such as a BaaS provider. (Banks don’t technically hold lending licenses, since that’s something suited for nonbanks. Instead, their charters enable them to extend loans.)

- Working with a BaaS provider: The platform works with a BaaS provider that provides easy-to-use APIs for integration and program manages legal and compliance oversight on behalf of its partner bank(s). The partner bank is the lender of record, and the platform can become the “creditor” by purchasing what’s called “receivables.” Think of receivables like debt—the platform purchases debt from the bank via the BaaS provider, and the platform then has that debt on its balance sheet. The platform will “hold” that debt for its customers (the business account owners) until the debt is due. The account owners will then pay the platform, offsetting the debt.

It’s important to note that in all options, the platform carries some oversight from the bank sponsor, although the level of oversight may vary depending on the model.

|

貸金業ライセンスを取得する場合

|

銀行と直接提携する場合

|

BaaS プロバイダーと提携する場合

|

|

|---|---|---|---|

|

プラットフォームの責任

|

アメリカのどの州でも、プラットフォームで貸金業を行うには、関連するライセンスを申請する必要があります。融資が始まると、プリペイドカードやデビットカードにその資金を移すことになります。さらに、カードを発行するために銀行や BaaS プロバイダーとの提携が必要になります。

プラットフォームはこの方法で信用を拡大できますが、カードに信用限度枠がないため、このサービスは厳密には支払いカードではありません。

|

プラットフォームは銀行と提携して、補償、宣伝、データの所有者やプライバシーなど、法的合意や契約事項について取り決めます。また、銀行の API と直接接続します。

さらに、プラットフォームは、銀行との関係を管理し、銀行の要件を満たすため、少なくとも 2 人の人員 (コンプライアンスマネージャーとプログラムマネージャー) を雇用することが求められます。このような銀行の要件としては、コンプライアンスに関する方針や手順の策定、従業員への教育訓練の実施、プラットフォームの金融サービスについて継続的な統制、リスク評価、検査および報告を行う体制の確立などが挙げられます。

|

プラットフォームの責任は BaaS プロバイダーによって異なります。

たとえば、Stripe の支払いカードプログラムの場合、プラットフォームは企業ごとにリスク評価基準の策定や信用限度額の設定を行いますが、Stripe がインフラストラクチャをすでに構築しているため、銀行スポンサーを手配する必要はありません。また、継続的な検査、教育訓練および報告によって提携銀行のコンプライアンス要件を遵守するにあたり、プラットフォームは Stripe と連携しなければなりません。

|

|

メリット

|

信用取引を始めるのは銀行ではないため、サービス全体がプラットフォームの管理下に置かれます。

|

プラットフォームは銀行と直接提携するため、貸金業ライセンスを取得する必要がありません。また、通常は、プラットフォームがサービス全体を比較的自由に管理できるほか、銀行と直接やり取りしてリスク評価プロセスを設計できます。

大規模プラットフォームの場合は、銀行と直接提携することでインターチェンジフィーのレベニューシェアが増える可能性があります。

|

BaaS プロバイダーの提携銀行と直接取引するため、プラットフォームは貸金業ライセンスを取得する必要がなく、提携先の銀行を探す必要もありません。BaaS プロバイダーを介することで、信用取引が可能な経費用カードを短期間で作成して提供できます。

プラットフォームは、BaaS プロバイダーから、ポリシー、テスト用リソースおよびコンプライアンスに関するサポートを受けたり、信用取引や帳簿作成、コンプライアンス、顧客確認 (KYC) および企業からの継続的な返済の処理に役立つ、使いやすい API や製品ソリューションの提供を受けたりすることのできます。

|

|

考慮事項

|

貸金業ライセンスを取得するプロセスは面倒な上、貸金業に関する要件は州によって異なります。通常、ライセンスが必要な州のライセンスを取得するには数年かかります。

準備が終わると、プラットフォームは規制監視の対象となりますが、適用要件は州によって異なります。そのほか、カードを発行した銀行パートナーや BaaS プロバイダーからもコンプライアンスの監視を受けることになります。

最後に、プリペイドカードやデビットカードを取り扱う場合、プラットフォームが受け取るインターチェンジ収益が低くなる可能性があります。

|

銀行と直接提携する場合は、導入費や管理費が高くなることが予想されます。準備にはかなりの時間がかかり、プラットフォームの規模によっては 12 カ月かかる場合もあります。

プラットフォームは、銀行との関係や継続的なコンプライアンス要件に対処するため、人員を増やすことを検討する必要もあります。

|

プラットフォームによる支払いカードの提供に適用されるクレジットポリシーとリスク評価は、BaaS プロバイダーと提携銀行による承認と監視の対象となります。クレジットポリシーの実施や適用はプラットフォームが管理するものの、クレジットポリシーの所有権は提携銀行に帰属し、提携銀行は (多くの場合、BaaS プロバイダーを介して) クレジットポリシーを監視します。

|

|

最適な企業

|

すでに貸金業ライセンスの取得作業を終えているプラットフォーム。 | 貸金業を主力商品としており、大規模なコンプライアンスチームと BaaS インフラストラクチャへの投資を予定しているプラットフォーム。 | スピーディーな市場投入を実現し、諸経費を最小限に抑えてサービスを推進したいと考えているプラットフォームや、貸金業を商品ラインアップに含めて企業に提供したいと考えているプラットフォーム。 |

What about merchant cash advances? Generally speaking, merchant cash advances (MCAs) aren’t loans. Instead, they’re an alternative to traditional loans, where a platform (or a “factoring company”) can offer a business access to its future revenue by purchasing receivables from its potential future revenue in exchange for a discount. The end result is that the business has access to (discounted) cash now and must pay the platform back as it receives revenue over time. MCAs generally carry more financial risk to the platform than loans. They’re normally repaid by giving the platform a percentage of sales that are withdrawn directly from a business’s revenue; however, if the business fails to generate revenue, the platform loses the profit altogether. Because of this, MCAs are also subject to different regulations than traditional lending, generally on a state-by-state basis. MCAs could also prove risky from a compliance standpoint since regulators are catching on to the fact that some companies use MCAs to circumvent lending laws. Consult your lawyer to learn more.

Setting up repayment

After funds are borrowed via a charge card, businesses need to repay their funds periodically—typically, every 15 or 30 days. In the context of charge cards, repayments normally include both the credited amount and fees—and the sum total of both are due at the end of every payment cycle. Repayment procedures should also specify what the borrower should do if they are unable to make a scheduled payment, including any special accommodations made for hardships.

You can set up repayments from cardholders for charge cards in several ways, which require you to decide how often to collect repayment and the method you’ll use to collect repayment.

How often you want to collect repayment from users is dependent on your working capital, the average amount your users are spending, and the working capital of your users. These settings should be available through your BaaS provider’s APIs. For example, Stripe’s APIs allow you to set repayment to happen weekly, monthly, on a particular day each month (e.g., the 15th of every month), or even every recurring 60 days.

When choosing the repayment method, make sure it’s easy for your cardholders to send you the repayment. Your BaaS provider should be able to provide you with guidance and mechanisms to easily collect repayment that’s consistent with best practices under applicable laws. For example, Stripe has a suite of payment products, like Invoicing and Checkout, that make it easy to collect repayment while minimizing a platform’s overall integration work.

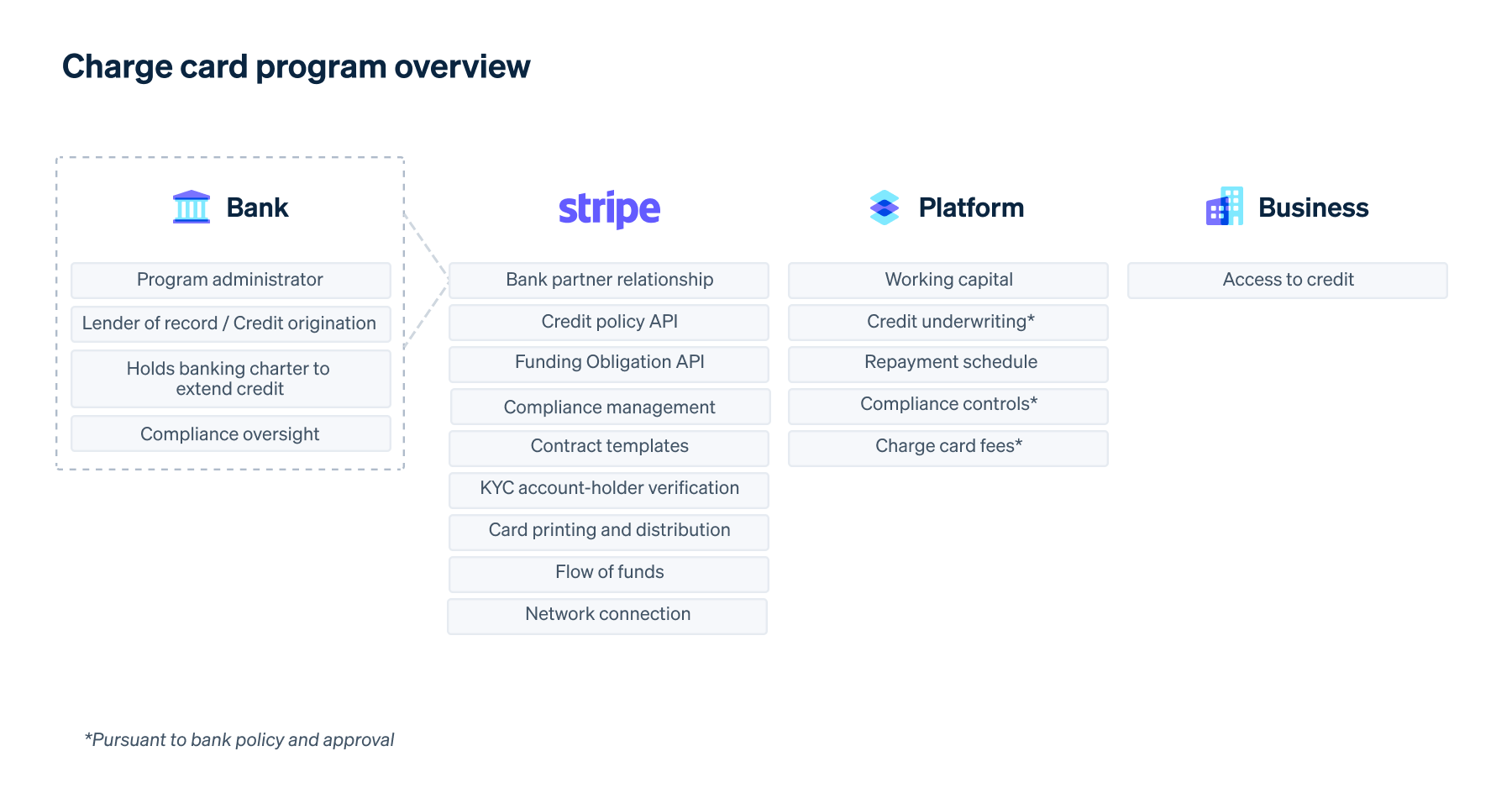

How Stripe helps

Setting up a charge card offering on your own is complicated and is time and resource intensive. It may involve finding a bank partner, getting multiple financial services licenses, hiring legal experts, issuing cards, and deploying significant engineering resources. In addition, the underwriting costs and economic risks of businesses who may not be able to repay on time can be high.

Fortunately, Stripe can help. Stripe Issuing already takes on many of the components of offering cards (bank partnerships, funds flows, regulatory and compliance navigation, network connection, card printing and distribution, and integration APIs), but we also have features specifically for platforms wanting to offer charge cards:

- A compliance-first charge card program

- Capital-efficient funding options

- Integrated repayment options

Stripe Issuing’s charge card program

Our charge card program consists of two key parts—our receivables purchase program and our APIs.

Receivables purchase program

Our receivables purchase program (RPP) is our legal, compliance, and lending solution that enables platforms to offer businesses access to credit via our bank partners. Our partner banks are the lenders of record, and platforms can purchase receivables from the bank via Stripe. Our RPP enables platforms to offer businesses access to credit, without having to acquire lending licenses or navigate state-specific licensing requirements by themselves.

Platforms can also lean on Stripe’s compliance resources, such as our compliance policies, to set up and maintain a compliance-focused charge card offering. Our team works hand in hand with platforms to design a charge card offering that adheres to regulatory and partner bank requirements. Stripe’s compliance team has a kickoff with each platform, followed by a series of guided checklists and discussions to confirm the platform’s offering has all of the right processes, disclosures, reporting, and controls in place for final bank review and approval. We also conduct periodic reporting and testing activities on behalf of the partner bank in order to help manage the platform’s risk on an ongoing basis and to meet the ongoing monitoring expectations of our partner banks.

-

No additional lending license or bank partnerships needed

-

Offer a lending program across all 50 states

-

Access to robust compliance resources

Our APIs

Our credit APIs can set credit limits and billing terms for each user and supports flexible repayment options such as weekly, monthly, etc. Platforms can make a single API call to retrieve the amount a business owes at any point in time, instead of manually calculating how much credit has been spent and accounting for refunds and disputes. They also help to manage each account’s credit obligation, which is automatically updated as the user spends, receives a refund, or wins a dispute. Platforms can use this API to create and manage a ledger that tracks how much credit has been extended to, spent by, and repaid by businesses.

Capital-efficient funding options

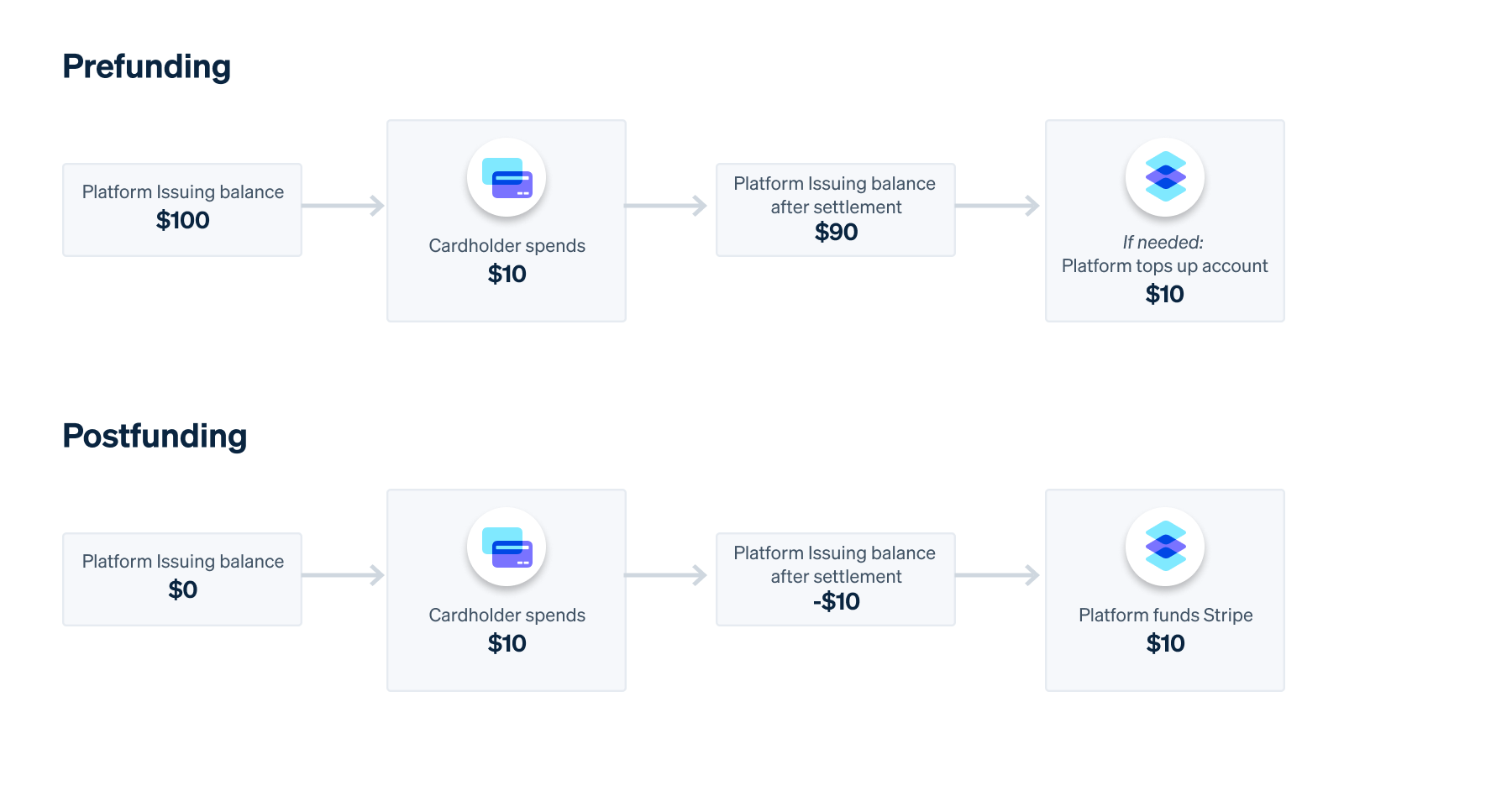

There are two ways a platform can fund its charge card offering with Stripe—prefunding and postfunding.

With prefunding, funds are readily available in a platform’s account to cover a cardholder’s future transaction. However, with postfunding, the platform funds its account only after a cardholder’s transaction is captured.

Generally, a postfunding model is more capital efficient than prefunding, since the platform doesn’t have to hold funds in an account with Stripe, providing them with more working capital. Most platforms see a >20% improvement in working capital by postfunding cards.

|

事前資金調達

|

事後資金調達

|

|

|---|---|---|

|

メリット

|

これは、準備資金の調達を素早く簡単に行う方法として一般的です。Stripe では、事前資金調達に最低準備金を必要としません。Stripe で最も人気がある資金調達方法で、ほぼすべてのプログラムでこのオプションから始めることをお勧めします。 |

プラットフォームは口座に資金を入れておく必要がありません。そのため、支出額を予測する必要がなく、残高不足によって取引が拒否されることもありません。

また、多くの場合、事後資金調達の準備金として必要な資金は事前資金調達で必要となるバッファーよりも大幅に少ないため、プラットフォームの資本効率が向上します。

|

|

考慮事項

|

事前資金調達の場合、カード保有者の支出に対応できるよう十分な資金をプラットフォームの口座に入れておく必要があるため、予想金額が高くなる可能性があります。そのため、予期しない急増や多様な支出パターンを考慮する必要があります。取引の拒否が発生しないよう、十分と思われる金額よりも多めに資金を用意しておくことがベストプラクティスです。 | 事後資金調達の場合、準備に時間がかかり、追加のプログラムコストが発生します。他のフォワードフロー投資の手配と同様、通常、プラットフォームはキャッシュリザーブを計上する必要があります。 |

Integrated repayment options

Platforms can use our payments products to minimize their overall integration work, while also making it easy to collect repayment.

Two no-code, prebuilt payments products Stripe offers today are Checkout and Invoicing:

- Stripe Checkout is a prebuilt hosted payment page that supports one-time or recurring payments through a variety of payment methods, including bank accounts. Checkout is optimized for conversion and makes it easy for businesses to reuse payment information. Businesses come to a platform’s checkout page to make a payment.

- Stripe Invoicing can send invoices to businesses in minutes, without any code. It also has advanced features to automate accounts receivable, collect payments, and reconcile transactions. Invoicing is also optimized for conversion, with 87% of invoices paid within 24 hours.

Platforms can also choose to collect repayment outside of Stripe products.

Access to the full Stripe platform

In addition to Stripe Issuing and our charge card program, Stripe has an entire ecosystem of financial infrastructure products that can be combined in different ways:

- Stripe Treasury provides a flexible BaaS API to build full-featured financial products for your customers, whether it’s a store-and-spend account or spend-management offering. With Treasury, you have the core building blocks to create financial accounts, store funds, move money between parties, and attach cards for spending.

- Stripe Capital provides your platform on Stripe Connect with an end-to-end lending API that enables you to offer access to fast and flexible financing to help your customers grow their businesses. With Capital, your customers don’t have a lengthy application process, and repayment is automatic.

- Stripe Connect allows you to embed multiparty payments and offer a variety of financial services, such as collecting payments from your customers and paying out third parties. Platforms earn revenue by collecting fees for services provided.

- Stripe Financial Connections lets your users securely connect their existing financial accounts and share their financial data with your platform.

- Stripe Identity lets you programmatically confirm the identity of global users to comply with KYC regulations.

Get in touch with our team to learn more about how your platform can use Stripe to set up a charge card offering for your customers.

Notes

- The credit policy and underwriting for a platform’s charge card offering is subject to the BaaS provider and partner bank’s approval and oversight. The platform works with its BaaS provider and partner bank to design a credit policy that aligns to its own risk appetite.

- Stripe Card survey conducted among 770+ small to medium-sized businesses in the US about commercial banking experiences.

- In many US states, lending within certain parameters (such as having no or low finance charges or only extending credit to commercial entities) can be pursued without obtaining licenses. However, many big markets, such as California and Nevada, likely do not fall within this category since they have stricter lending license requirements. Consult your lawyer to learn more.