One of the reasons indirect tax (sales tax, VAT, and GST) compliance is so challenging is because laws and regulations change frequently. Not only do tax authorities change which products and services are taxable, but things like rates, filing frequencies, and where businesses need to file also change often.

To help you prepare for 2024, we’ll share a summary of compliance trends happening around the globe and how they could impact your business. We’ll also share resources to help you navigate tax compliance. This article is intended to be informative only—please consult with your legal counsel and/or tax advisor for advice specific to your business.

Cross-border ecommerce and digital taxation

Cross-border ecommerce has opened new avenues for businesses to reach customers far beyond their national borders. However, this trend has also brought about complexities in taxation. Over 100 countries have imposed obligations on foreign businesses to register and collect local tax. While these tax requirements traditionally apply to digital services, more countries are expanding them to remote services like accounting, legal, and consulting and to low-value goods. In 2023, Singapore started requiring nonresident businesses to charge and remit GST on consumer (B2C) sales of low-value goods and nondigital services. Also in 2023, Norway imposed a tax collection obligation on foreign businesses providing remote services to local consumers. In Malaysia, tax collection regulations on imported low-value goods entered into force in January 2023 but have not been enforced yet. The Philippines and Israel are currently considering new laws for remote sellers of digital services.

In the US, states continue to make changes to existing sales tax laws that could have an impact on interstate commerce. In 2023, both Louisiana and South Dakota removed the 200 transactions requirement from the economic nexus threshold, streamlining compliance requirements for small sellers. This is following the lead of a few states that removed the transaction requirement in 2022. In addition, states might begin to change their position on taxing certain digital services. For example, in July 2023, Michigan clarified that it will tax cloud computing as prewritten software if there is a downloadable component.

What this means for you: Businesses venturing into international markets or into new states must have a clear understanding of the extent of tax compliance obligations that apply in the countries where their customers are situated.

How Stripe can help: With Stripe Tax, you can see where you need to collect taxes based on your Stripe transactions and, after you register, you can switch on tax collection in a new state or country in seconds, depending on availability.

Platform economy challenges

In recent years, the world has witnessed the rapid ascent of the global platform economy with digital platforms seamlessly connecting buyers and sellers across the globe. This shift has created a fresh set of challenges for indirect tax systems worldwide. These challenges predominantly revolve around three key domains: tax compliance obligations for platform-based sellers, categorization of platform facilitation services, and tax collection liability.

In response to the rapid growth of the platform economy, numerous countries, including Switzerland, Japan, and New Zealand, are planning to expand tax collection obligations for platform operators. A second discernible trend involves augmenting reporting obligations for these platforms. Such reporting serves as a means for tax administrations to scrutinize whether platform sellers have accurately reported their earnings and fulfilled their tax obligations. These obligations, however, can prove onerous. For example, the European Union requires that an accommodation platform disclose the address of every property listed for rent. The UK has recently enacted rules mandating UK digital platforms to annually collect and report income information from sellers who use their platforms for personal services, tangible goods sales, and the rental of immovable property or transport. The UK rules will take effect starting from January 1, 2024, with the initial data reporting due in January 2025.

The EU has taken noteworthy steps in addressing tax challenges of the platform economy through two pivotal reform proposals: “VAT in the Digital Age” (ViDA) and Customs Union Reform. These proposals aim to broaden the scope of tax collection obligations to include platforms operating within the short-term accommodation rental and passenger transport sectors. In addition, ecommerce platforms will be entrusted with the responsibility of collecting VAT on all goods sold within the EU, irrespective of the purchaser’s status or the supplier’s location. An additional aspect of these reforms is the establishment of a bespoke customs regime. Under this regime, platforms facilitating ecommerce transactions will manage all customs formalities and payment obligations, effectively eliminating the existing €150 threshold. Additionally, it will mandate the use of the Import One-Stop Shop (IOSS) for platform operators, streamlining the process of declaring and remitting VAT on distance sales of goods imported from non-EU countries.

In the US, all states with a sales tax also have marketplace facilitator laws. While marketplace facilitator laws are the new norm, it can be challenging for marketplaces to determine their obligations. This is due to the fact that no single definition exists for “marketplace facilitator,” with definitions varying among state tax laws. Additionally, many US states still do not provide guidance on marketplace facilitator rules in the sharing economy (short-term rental platforms, ride-sharing services, and food delivery platforms). Finally, numerous states and local jurisdictions have expanded collection and remittance requirements for marketplace facilitators beyond sales tax.

What this means for you: As platforms and marketplaces take on greater tax collection responsibilities, their compliance costs could increase. Conversely, platform sellers (i.e., the businesses that sell on platforms or marketplaces) will face reduced compliance burdens, enabling them to expand internationally at a quicker pace.

How Stripe can help: Having a tax solution that is designed for platforms and marketplaces will help support compliance efforts. By using Stripe Connect and Tax together, platforms can automate tax calculation and collection for their users.

Tax simplification initiatives

If you’ve completed an indirect tax return, you likely understand how challenging tax compliance can be, and how much time it can take to maintain.

In the US, one reason tax compliance is so complex is because of home rule states. Home rule states allow individual home rule cities to administer their own sales taxes as well as define their own tax bases. These cities can define their own tax rules, and sellers may be required to complete additional registrations in these areas. The following are home rule states: Alabama, Alaska, Arizona, Colorado, and Louisiana. For these areas, businesses often have to file multiple returns in one state.

However, we’re seeing a few states take the first step to simplify tax compliance for sellers. For example, Colorado has a Sales and Use Tax Simplification Task Force that is charged with studying the components of a simplified sales tax system and the benefits it would create for sellers. Louisiana is also working towards simplification by considering a centralized return, combining both state and local (home rule) returns into one return.

Tax simplification efforts are also underway globally. In line with the “VAT in the Digital Age” reform package, the European Union has introduced the idea of a single VAT registration location. This initiative, if passed, aims to reduce the instances where EU businesses must register in a member state where they lack a physical presence. The goal is to eliminate the need for multiple registrations by expanding the One-Stop Shop regime (which allows businesses selling across multiple EU countries to register and report all eligible sales in one member state), introducing a new OSS regime for transfers of the merchant’s own goods to other EU member states, widening the scope of mandatory reverse charge, and extending the scope of the platform tax collection liability.

Another significant development is the progress made on Brazil’s indirect tax reform. In July 2023, Brazil’s Chamber of Deputies approved a historic tax reform aimed at simplifying the complex indirect tax system which involves multiple layers of taxes levied at different government levels, leading to occasional overlaps. If enacted, these changes will be implemented gradually, starting in 2026.

What this means for you: An extension of the OSS scope to cover more B2C supplies is a welcome step in reducing the VAT administrative burden related to cross-border trade. There is hope for a more simplified tax compliance process in the US, but there’s still work to be done. In the meantime, businesses should be aware of the different filing processes and ensure they are meeting all requirements to avoid fees and penalties that come with late filings.

How Stripe can help: Stripe generates itemized reporting and tax summaries for each US filing location, helping you easily file and remit taxes on your own, with your accountant, or with one of Stripe’s filing partners. Consult with your tax advisor to understand how specific requirements might apply to your business. In the EU, Stripe supports all OSS regimes and can help you calculate taxes on sales falling under these simplification schemes.

Increase in sales tax complexity

In addition to home rule states, there are often multiple tax types for businesses to manage. For example, with the rise of delivery during the pandemic, many states introduced a retail delivery fee. The Colorado retail delivery fee applies to all deliveries made to a location in Colorado where at least one tangible personal property item is subject to sales tax. Now, businesses are left managing sales tax in addition to these delivery fees. Both New York and Minnesota have introduced their own retail delivery fee in 2023, although Minnesota’s doesn’t go into effect until January 2024. Another example is the Chicago Lease Tax (Personal Property Lease Transaction Tax). This tax applies to remote sellers including SaaS companies and digital goods sellers, whose sales into Chicago exceed the threshold of $100,000. This is in addition to any sales tax requirements in the city and includes companies based outside of the US.

There has also been a trend of states introducing more sales tax holidays than we’ve seen in the past, likely driven by inflation and economic uncertainty. Sales tax holidays are created to drive retail spending by providing days where consumers can make purchases without paying sales tax. Back-to-school shopping and weather emergency preparedness are popular types of sales tax holidays. However, these types of holidays are not always straightforward. For example, in Tennessee, there is a grocery sales tax holiday that temporarily exempts grocery items from sales tax for a three-month period. In Texas, there is a water efficiency sales tax holiday that exempts sales tax on purchases that try to eliminate water waste.

Keeping up with set holidays and what is exempt is challenging enough. On top of that is the fact that most states don’t announce holidays very far in advance. In some states, businesses are required to honor sales tax holidays.

What this means for you: Since states add holidays and new tax legislation often, businesses should consider how investing in a tax automation software could help keep them compliant as sales tax compliance continues to get more complex.

How Stripe can help: Stripe Tax supports sales tax holidays as well as provides support for additional tax types like the Chicago Lease Tax.

Real-time compliance changes

Real-time compliance revolves around the immediate transmission of data to tax authorities as soon as a transaction occurs or shortly after. This approach is in contrast to periodic tax compliance, which involves filing returns on a monthly or quarterly basis. The shift toward real-time compliance initially emerged in Latin America and is now gaining traction worldwide. Multiple countries have already adopted real-time compliance systems, while others are actively in the process of doing so.

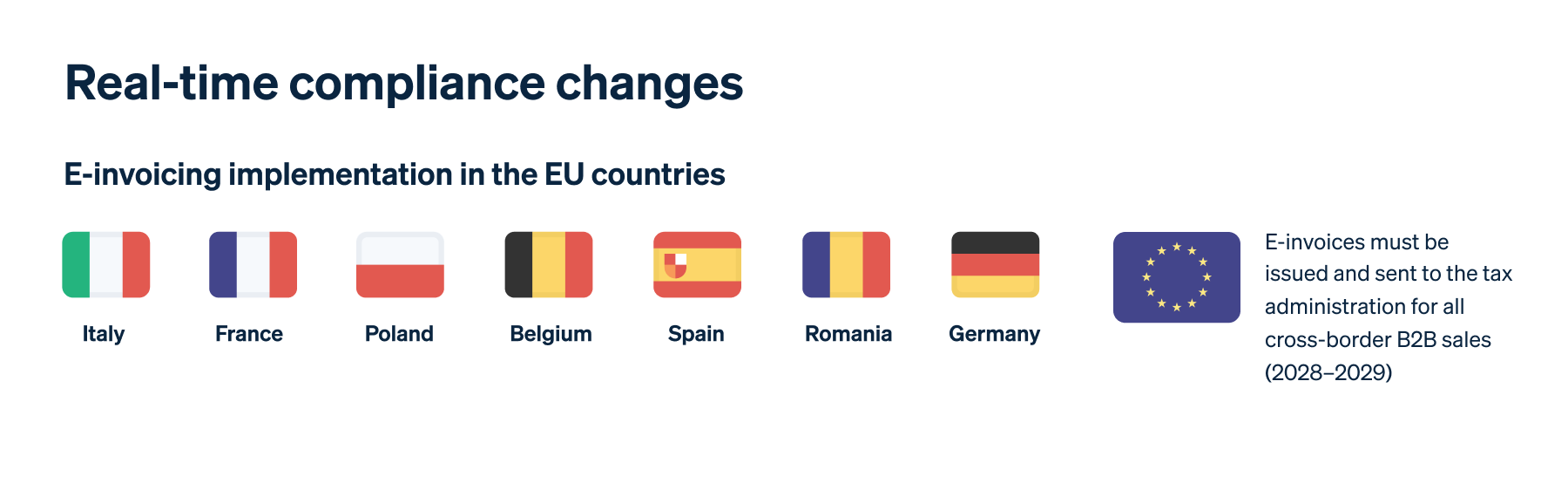

A common form of real-time compliance is the implementation of mandatory electronic invoicing (e-invoicing), which means that businesses must issue invoices in a structured machine-readable format and report invoice data to the government. In the European Union (EU), e-invoicing is only mandatory in one member state, Italy. However, several other EU nations are following Italy’s lead and planning to make e-invoicing obligatory in the near future. While specific timelines for France, Romania, Belgium, Spain, and Germany have yet to be determined, mandatory e-invoicing will take effect in Poland in July 2024. E-invoicing regulations within the EU are not uniform; each country employs varying transmission methods and data formats. The fact that each country employs its unique e-invoicing approach creates significant challenges for cross-border trade within the EU.

To address this issue, the EU has proposed the “VAT in the Digital Age” (ViDA) reform. Under these proposed reforms, all businesses engaging in business-to-business (B2B) transactions, whether goods or services, with customers in other EU member states will be required to issue e-invoices. Furthermore, they must report specific invoice data to tax authorities no later than two working days after the invoice is issued. EU member states that already have transactional reporting requirements in place for domestic sales will need to align with the new EU standard for cross-border sales, likely by 2028.

In the US, there is also a movement towards e-invoicing that would require companies to have a real-time compliance solution in place and be prepared to comply with new requirements quickly. Leading the charge is the Business Payments Coalition, a nonprofit association that promotes greater adoption of electronic payments and invoicing in the US. Its e-invoicing project would allow businesses to share electronic invoices and other relevant documents, regardless of what system they use in-house. It kicked off an e-invoicing pilot in 2022, which was driven by large businesses looking for tax efficiencies.

What this means for you: Real-time compliance is becoming a global norm, with e-invoicing at the forefront. However, the challenge lies in staying compliant with these diverse approaches across countries. If you’re established in countries that are planning to implement mandatory e-invoicing, you must ensure that you are able to comply. While electronic invoices are not mandatory in the US at this point, they are likely to be the standard in the near future, and businesses should begin searching for a solution that can provide these types of invoices now.

How Stripe can help: To help you remain compliant with e-invoicing obligations, the Stripe App marketplace provides apps from trusted partners that offer e-invoicing support for a variety of use cases and markets you may require.

Rate changes to tackle inflation

High inflation is still a prevalent issue in major global economies. Many countries have turned to indirect taxes as a tool to counteract this concerning trend. Several countries have introduced temporary VAT reduction. These reductions have primarily targeted essential items such as energy and food. However, lowering VAT rates is not the only strategy countries are employing to combat inflation and budgetary problems. For instance, Estonia, Singapore, and Switzerland have already confirmed that they will implement rate increases in 2024. In July 2023, Turkey announced a VAT rate increase for all goods and services with a two-day notice for both domestic and foreign businesses to Turkish customers.

In the US, a few states are managing inflation by reducing sales tax rates. New Mexico lowered the state portion of the gross receipts tax from 5.125% to 4.875%. In July, South Dakota decreased its state sales tax rate from 4.5% to 4.2%. In addition, states often make changes to which products are taxed throughout the year. For example, Texas recently updated its tax code to eliminate the sales tax on family care items like menstrual products, baby bottles, and diapers.

What this means for you: Businesses must be prepared for the diverse approaches that countries, states, and jurisdictions may adopt and remain adaptable enough to implement new tax rates swiftly when laws change. For businesses selling in multiple locations, these changes could happen hundreds of times a year.

How Stripe can help: Stripe Tax calculates and collects the correct amount of tax, wherever you sell. It supports hundreds of products and services and stays up-to-date on tax rule and rate changes so you don’t have to.

Tax compliance resources

Tax laws can change quickly, so trying to keep up with all the new information can be daunting. Here are a few resources to help guide your tax compliance in 2024:

- Introduction to indirect tax compliance: Sales tax, VAT, and GST

- Introduction to US sales tax and economic nexus

- Introduction to EU VAT and VAT OSS

- Navigating the sales tax registration process in the US

- Navigating the VAT registration process in Europe

- Navigating the GST registration process in Canada

- How to file sales tax returns in the US

- A guide to sales tax and VAT for marketplace sellers

- How to evaluate tax automation software

- Introduction to SaaS taxability in the US

Ensuring your business stays tax compliant begins with understanding where you have tax obligations. Then, you need to register with the local tax authority, calculate and collect the right amount of tax, and finally, file and remit the tax collected.

How Stripe can help

While staying aware of tax compliance trends is important for businesses, it’s also complex and time-consuming. Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT, and GST on both physical and digital goods and services in all US states and in 50 countries. Start collecting taxes globally by adding a single line of code to your existing integration, clicking a button in the Dashboard, or using our powerful API.

Read our docs to learn more or sign up for Stripe Tax today.